Introduction

The Employees’ Provident Fund (EPF) is a retirement savings scheme managed by the Employees’ Provident Fund Organisation (EPFO). When an employee switches jobs, it is essential to transfer the EPF account to the new employer to ensure continuous savings and avoid withdrawal penalties.

Thanks to online EPF transfer services, employees can now seamlessly transfer their EPF balance from the old employer to the new employer through the Unified Member Portal. This guide explains the step-by-step process for EPF account transfer, required documents, and how to check the transfer status.

Why EPF Account Transfer?

- Retains Interest Benefits

- EPF accounts earn interest even if inactive but transferring ensures continuous contributions.

- Avoids Premature Withdrawal

- Withdrawing before 5 years results in tax deductions.

- Simplifies Future Withdrawals

- Having a single unified EPF account makes withdrawal hassle-free upon retirement.

- Ensures Higher Pension

- If EPF is linked to the Employee Pension Scheme (EPS), continuous service increases pension eligibility.

Eligibility Criteria for EPF Transfer

Unified Account Number (UAN) must be active

Both previous and current employers must have registered digital signatures

EPF KYC must be updated (Aadhaar, PAN, and bank details)

Only one EPF transfer request is allowed per employment change

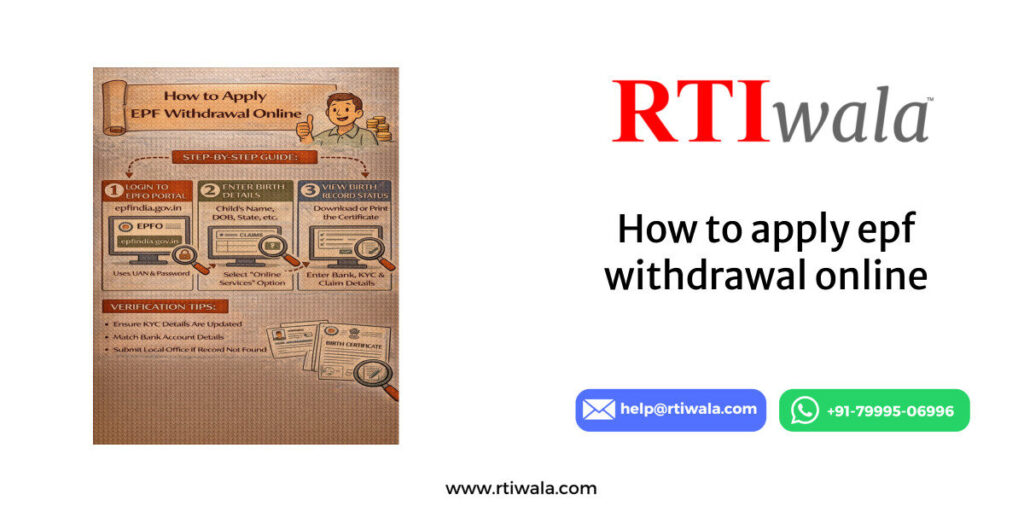

How to Transfer EPF Account Online?

Step 1: Login to the EPFO Portal

- Visit the EPF Member Portal: https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Enter UAN, password, and captcha to log in.

Step 2: Go to “One Member – One EPF Account (Transfer Request)”

- Navigate to “Online Services”.

- Click on “One Member – One EPF Account (Transfer Request).”

Step 3: Verify Previous & Current Employer Details

- Enter your old EPF account details or Member ID.

- The system will fetch both previous and current employer details linked to your UAN.

Step 4: Select the Employer for Verification

- Choose either:

- Previous Employer OR

- Current Employer for attestation.

- Generally, selecting the current employer is recommended as processing is faster.

Step 5: Generate and Submit the Transfer Request

- After verification, click “Get OTP” (sent to your registered mobile linked with Aadhaar).

- Enter OTP and submit the transfer request.

Step 6: Download the Transfer Form (Form 13)

- After submission, download Form 13 and submit it to your employer (if required).

Step 7: Track EPF Account Transfer Status

- Visit “Track Claim Status” in the EPF Member Portal.

- Enter UAN and check whether the transfer request is Pending, Approved, or Completed.

EPF Transfer Timeframe

| Stage | Processing Time |

|---|---|

| Employer Approval | 7–10 working days |

| EPFO Processing | 15–30 working days |

| Transfer Completion | 1–2 months |

Documents Required for EPF Transfer

UAN (Universal Account Number)

EPF Member ID (Old and New Employer)

Aadhaar-linked Mobile Number

Bank Account Details (for KYC verification)

Cancelled Cheque (sometimes required for verification)

How to Check EPF Transfer Status?

Method 1: EPFO Portal

- Log in to EPF Member Portal.

- Navigate to “Track Claim Status”.

- Enter UAN and view the current status.

Method 2: UMANG App

- Download the UMANG App from Play Store/App Store.

- Select EPFO Services > Track Claim.

- Enter UAN to check transfer status.

Method 3: EPFO Helpdesk

- Call EPFO Toll-Free Number: 1800-118-005.

- Provide UAN and Member ID for inquiry.

Common Issues in EPF Transfer & Solutions

| Issue | Solution |

|---|---|

| Employer Not Approving Request | Contact the HR department or file a grievance with EPFO. |

| Incorrect EPF Details | Update details through the employer before applying. |

| KYC Not Updated | Ensure Aadhaar, PAN, and bank details are verified in the portal. |

| Delay in Transfer Processing | Track status online and escalate with RTI if necessary. |

What If Your EPF Transfer Is Delayed?

If your EPF transfer request is stuck for more than 30 days, you can:

- File a Grievance on EPFiGMS Portal

- Visit: https://epfigms.gov.in/

- Select “Register Grievance” and provide UAN details.

- Use RTI to Check Status

- If no response is received from EPFO, file an RTI application under the RTI Act, 2005 to request the status of your transfer.

How RTI Can Help in EPF Transfer Delays

RTI can be used to:

Check the reason for the delay in EPF transfer processing.

Obtain information about employer approval or rejection status.

Seek clarification on fund transfer from old EPF account.

Request EPFO action for delay beyond the stipulated timeframe.

How RTIwala Can Help

If you’re facing issues with your EPF transfer, RTIwala provides:

- Filing RTI Online: Get updates on your EPF transfer request.

- Anonymous RTI Filing: Keep your identity protected while seeking information.

- Custom Drafting Services: Professionally written RTI applications tailored to your case.

- Follow-Up Support: Assistance in tracking and responding to EPFO queries.

RTIwala Service Promotion

Simplify your EPF transfer process with RTIwala trusted services:

- Expert Consultation: Get personalized advice on EPF transfer issues.

- Online RTI: File RTI to track EPF transfer status.

- Anonymous RTI: Maintain privacy while seeking EPF details.

- Custom Drafting: Professionally drafted RTI applications.