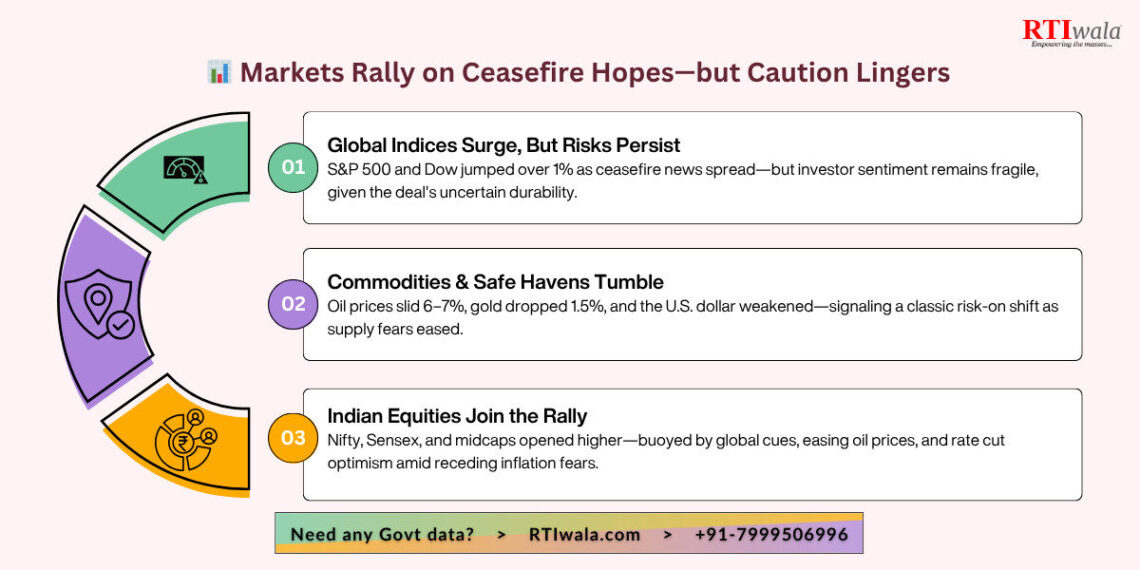

Global markets rallied on news of the fragile ceasefire between Iran and Israel, though investors remain wary of its longevity and broader geopolitical impact.

📊 Key Highlights:

1️⃣S&P 500 nears record highs, climbing ~1.1% to 6,092; Nasdaq-100 hit record territory; Dow surged 1.2% (+500 pts)

2️⃣Oil tumbled 6–7% (WTI ~$64–66/barrel; Brent ~$67/barrel), easing fears of disruption through the Strait of Hormuz

3️⃣Indian equities opened higher: Nifty +0.42% to 25,150; Sensex +0.48% to 82,449; small- and midcaps rose 0.4–0.6%

4️⃣Safe havens depressed: Gold prices dropped (~1.5%) and U.S. dollar slid as risk appetite improved .

5️⃣Yield expectations shift: 10-year U.S. Treasury yields eased (~4.29%) amid growing optimism for Fed rate cuts

🔍 What Stakeholders Should Note:

1️⃣Sector Rotation Opportunity: Energy and safe-haven asset downturn signals a rotation into cyclicals, financials, tech, and midcaps.

2️⃣Interest Rate Outlook: Lower oil-linked inflation and improved risk sentiment strengthen markets’ expectations for Fed dovishness later this year.

3️⃣Ceasefire Fragility: Market strides may be provisional—renewed hostilities can swiftly reverse gains.

🛠️ How RTIwala Equips Financial & Strategy Teams:

1️⃣Geo-Political Risk Maps Access Indian Ministry of External Affairs diplomatic cables and security advisories via RTI to gauge geopolitical sensitivity.

2️⃣Macro-Economic Forecasting Tap into government-import/export data, energy ministry inventories, and inflation indicators to refine economic models.

3️⃣Sector Rotation Signals Analyze corporate filings and public investment data to identify sectors poised for post-ceasefire inflows.

4️⃣Treasury & Forex Risk Track RBI and DGFT reports to benchmark rupee stability, FX reserves, and hedging strategy response.

🏭The Financial and Market Intelligence Industry Leaders:

Bloomberg, Thomson Reuters, S&P Global, Crisil, and Morningstar are recognized globally for delivering advanced financial analytics, risk modeling, and market insights.

🚀And, these are the remarkable startups of financial intelligence industry :

Marketsmojo, smallcase, Finshots, Cube Wealth, and YUB Realty Inc.- Your Ultimate Brokers—transforming how Indian investors, analysts, and institutions access market data, portfolio strategy tools, and macroeconomic intelligence.

In volatile environments, RTIwala empowers stakeholders with verified public data—enabling data-driven risk strategies, scenario simulations, and investment pivots grounded in reality, not headlines.

🔗 Connect with RTIwala

📌 RTIwala.com now!

📞 +91‑7999‑50‑6996 for expert help!

Strategize smarter—turn uncertainty into opportunity with public data intelligence.

RTIwala, Legaltech, AskRTIwala, Markets, GeoRisk, InvestmentStrategy

Need any Legal/RTI help?

Connect with the RTIwala Team instantly for quick assistance!

Markets React to Shaky Ceasefire: Risk-On Rally Amid Lingering Uncertainty

CRSORGI Birth Certificate Search – Verify Online

January 22, 2026

Get service record for government employees

January 22, 2026

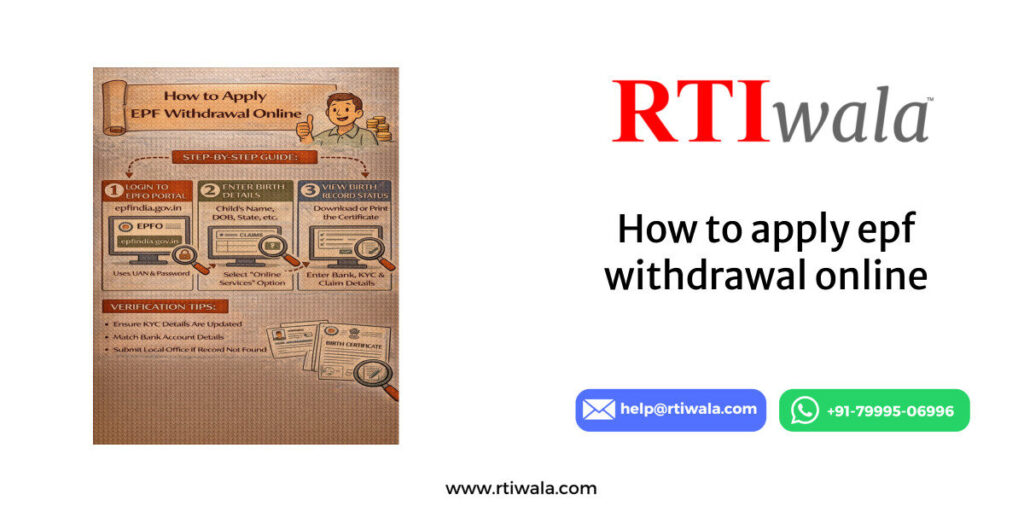

How to apply EPF Withdrawal Online

January 22, 2026

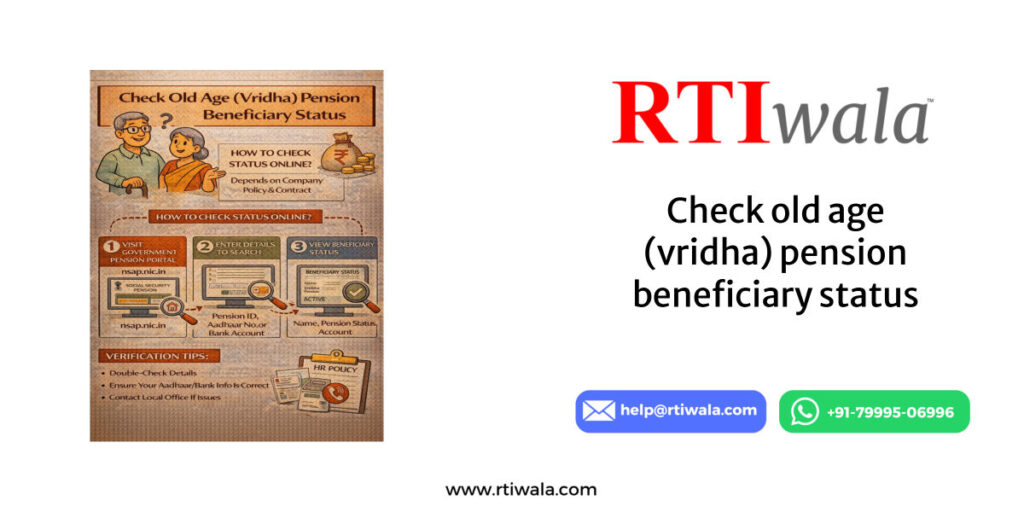

Check old age (vridha) pension beneficiary status

January 22, 2026

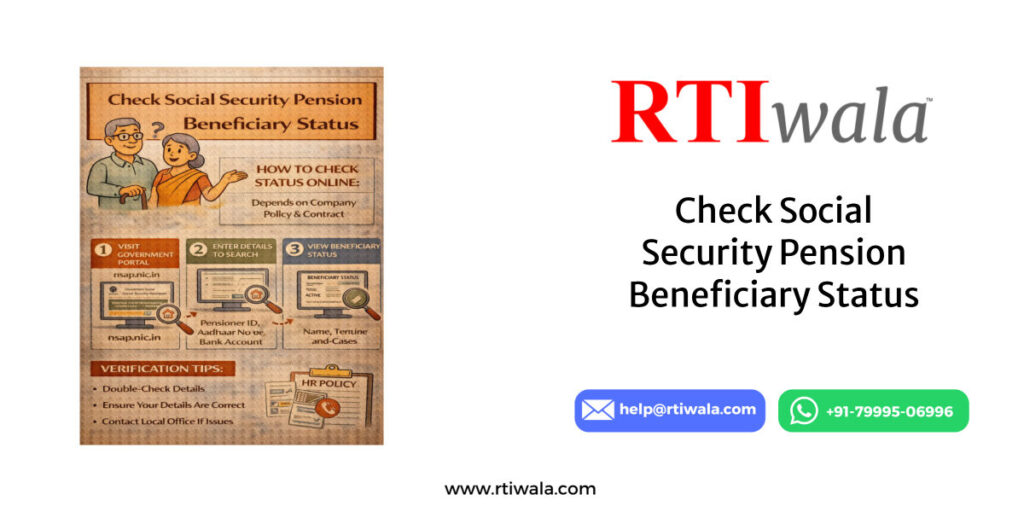

Check Social Security Pension Beneficiary Status

January 22, 2026

what is the retirement age in private companies in india

January 22, 2026

Empowering the masses...

RTIwala is a VC-backed legaltech startup empowering the masses through affordable result-driven legal solutions. We're helping people in exercising their Right to Information, Consumer Rights and fixing legal issues.