Table Of Content

Can RTI Be Filed Against a Co-operative Society? Legal Position Explained

This is the most searched and most confusing question for people facing issues with housing societies, credit societies, or employee co-operatives. The short answer is RTI cannot be filed directly against most co-operative societies—but this does not mean they are completely outside accountability.

Under the RTI Act, information can be sought only from a “public authority”. The Supreme Court of India has clarified that co-operative societies are generally private bodies, even though they are registered under a statute. Registration alone does not make them public authorities.

However, RTI can apply if the co-operative society:

- Is substantially financed by government funds

- Is controlled or managed by the government

- Performs public functions under government authority

The Supreme Court, in Supreme Court of India rulings, has repeatedly held that mere regulation by the Registrar is not enough to bring a co-operative society under RTI.

What this means for you practically:

- Filing RTI directly to the society often leads to automatic rejection

- The correct legal route is usually indirect RTI, which will be explained later

- Understanding eligibility before filing saves time, money, and appeals

This clarity helps you avoid the most common mistake RTI applicants make—filing RTI to the wrong authority.

Which Types of Co-operative Societies Come Under RTI Act

Not all co-operative societies are treated the same under RTI law. Some do fall within RTI scope, while most do not. Knowing the difference is critical because RTI officers reject applications that are filed blindly.

Co-operative societies likely to come under RTI include:

- Societies receiving direct government grants or subsidies

- Co-operative banks where the government holds controlling stake

- Federations or apex societies created by state legislation with funding

- Societies performing delegated public duties

Co-operative societies usually NOT covered under RTI:

- Housing societies formed by private members

- Employee welfare or staff co-operatives

- Credit societies without government funding

- Agricultural co-ops run purely by members

Key factor RTI authorities examine:

- Source of funding

- Extent of government control

- Nature of functions performed

- Whether public money is involved

If your society:

- Uses government land

- Receives interest subsidies

- Operates under government schemes

Then RTI applicability increases, but still needs careful legal framing.

This is why many RTI applications fail—not because information is illegal, but because the applicant didn’t establish RTI jurisdiction correctly.

Delayed action, ignored complaint, or missing reply? RTIwala uses RTI to force official accountability and written proof—act now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://cc.rti.link/wadp

🌐 www.rtiwala.com

When RTI Against a Co-operative Society Gets Rejected and Why

RTI rejections in co-operative matters are extremely common, and most rejections follow predictable patterns. Understanding these reasons helps you prevent rejection at the drafting stage itself.

Most common rejection grounds:

- “The co-operative society is not a public authority”

- “Information does not fall under RTI Act”

- “RTI Act not applicable to private bodies”

- “No substantial government funding involved”

Other technical rejection reasons include:

- RTI filed to the wrong department

- No mention of government control or funding

- Asking for internal society records directly

- Using emotional or complaint-style language instead of information-seeking

What applicants don’t realize:

- RTI officers do not investigate facts for you

- If funding/control is not clearly established, rejection is automatic

- Even valid information gets denied due to poor RTI framing

Practical reality:

- Rejections are not always wrong

- Most are due to procedural and jurisdiction errors

- Appeals fail when RTI was fundamentally misdirected

This is exactly why indirect RTI routes through the Registrar exist—and why strategic filing matters more than emotional filing.

How to File RTI Indirectly Through Registrar of Co-operative Societies

When direct RTI against a co-operative society fails, the Registrar of Co-operative Societies becomes the most powerful and legally valid RTI route. This method works because the Registrar is a public authority and legally supervises co-operative societies.

The Registrar maintains official records because:

- Co-operative societies are registered, audited, and regulated by the Registrar

- Annual returns, audits, inspections, and complaints are submitted to the Registrar

- The Registrar exercises statutory powers under state co-operative laws

RTI is filed not asking society questions, but asking:

- What records are available with the Registrar

- What actions were taken by the Registrar

- What documents were submitted by the society to the department

Correct authority:

- File RTI to Registrar of Co-operative Societies (State/District level as applicable)

What makes this method effective:

- Registrar cannot deny RTI applicability

- Information is already held “in official capacity”

- RTI falls squarely under Section 2(f) of RTI Act

Common filing mistake to avoid:

- Do not ask “Why society did this”

- Ask only for records, reports, filings, approvals, inspections

This indirect route is legally sustainable and survives First Appeal and CIC scrutiny.

Delayed action, ignored complaint, or missing reply? RTIwala uses RTI to force official accountability and written proof—act now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://cc.rti.link/wadp

🌐 www.rtiwala.com

What Information You Can Legally Ask From a Co-operative Society (Through Registrar)

Many people believe “nothing can be obtained” once RTI is rejected directly. That belief is wrong. A large volume of critical documents can still be obtained legally—if asked correctly through the Registrar.

You can legally ask for the following categories of information:

Registration & Governance Records

- Registration certificate copy

- Bye-laws approved by Registrar

- Amendments approved over time

- Managing committee approval records

Audit & Financial Oversight

- Statutory audit reports

- Special audit or inspection reports

- Action taken reports on audit objections

- Show-cause notices issued to society

Complaints & Regulatory Action

- Complaints received against the society

- File notings on complaint disposal

- Orders passed under Co-operative Act

- Penalties or warnings issued

Elections & Management Control

- Election schedules approved by Registrar

- Voter lists submitted to department

- Election dispute records

- Administrator appointment orders (if any)

Land, Assets & Approvals

- Approval of land use / property registration

- Government land allotment records (if applicable)

- Permissions granted for development or loans

Why this works legally:

- Information is held by the public authority

- RTI does not seek internal society opinion

- No exemption under Section 8 applies

Most successful RTIs focus on:

- “Provide certified copies”

- “Provide inspection reports”

- “Provide status of action taken”

This approach converts a private society problem into a government accountability issue—which is exactly what RTI is meant for.

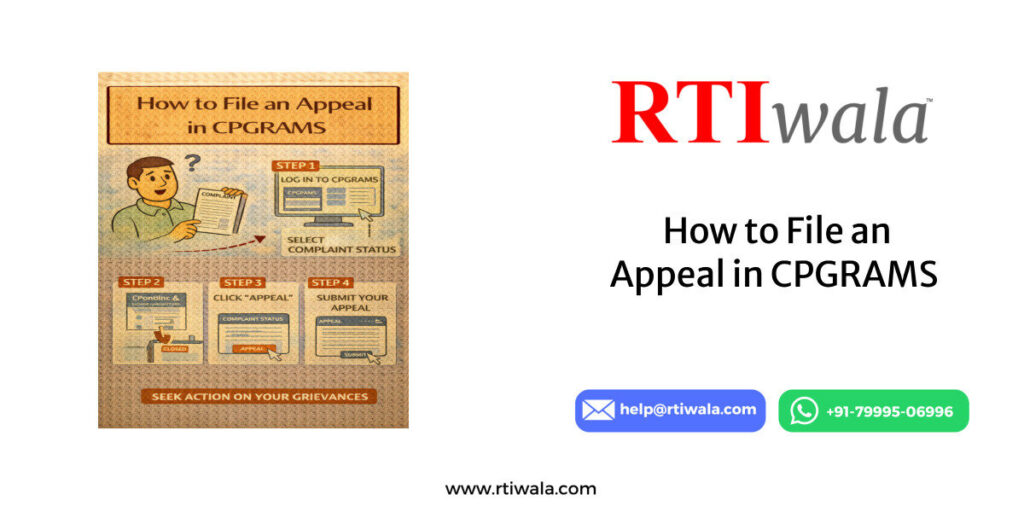

What to Do If Co-operative Society or Registrar Refuses Information

Even after filing RTI correctly through the Registrar of Co-operative Societies, many applicants face partial replies, vague answers, or outright denial. This stage is critical because wrong action here can permanently close your information route.

First, understand why refusal happens:

- Registrar claims “information not available”

- Response given without documents

- PIO shifts responsibility back to society

- RTI is replied with generic legal language

At this stage, silence or half-information is itself a violation of RTI Act.

Immediate steps you must take:

1. Identify the exact defect in reply

- Was information denied without citing RTI section?

- Were documents replaced with explanations?

- Was the reply incomplete or evasive?

Every refusal must legally mention:

- Specific RTI section

- Reason for denial

- Authority responsible

If not mentioned, it becomes a strong appeal ground.

2. File First Appeal within 30 days

- Appeal is filed to the First Appellate Authority (FAA) of Registrar’s office

- Do not repeat RTI questions

- Clearly point out:

- Missing documents

- Non-application of mind

- Violation of Section 7(1)

3. Demand records, not opinions

- Appeals fail when applicants argue emotionally

- Appeals succeed when applicants demand:

- Certified copies

- Inspection reports

- File notings

- Action taken records

4. If Registrar shifts blame to society

- This is legally invalid

- Registrar is custodian of records under Co-operative Act

- RTI applies to records held or controllable, not convenience

Most people stop here due to frustration. That’s a mistake. This is where RTI becomes powerful.

Practical RTI Strategy to Get Documents From Co-operative Societies

This section is the most important part of the entire guide. It explains how experienced RTI filers actually succeed, even when departments resist.

Strategy 1: Convert Society Issues into Departmental Accountability

Never ask:

- “Why society didn’t give records”

- “Why committee acted illegally”

Always ask:

- “Provide copies of records submitted by society”

- “Provide inspection conducted by Registrar”

- “Provide action taken on violations”

This shifts burden from society to government officer.

Strategy 2: Use Inspection-Based RTI Instead of Copies

When documents are denied:

- Ask for file inspection

- Ask for inspection date and time

- Under RTI Act, inspection cannot be denied casually

Once inspection is allowed:

- You can identify documents

- Then apply for certified copies

This bypasses most rejection tactics.

Strategy 3: Link RTI With Statutory Duties of Registrar

RTI becomes stronger when linked with:

- Audit duty

- Supervision duty

- Complaint disposal duty

Ask for:

- Audit objection compliance reports

- Registrar’s orders on society irregularities

- Action taken under specific sections of Co-operative Act

This makes denial risky for officials.

Strategy 4: Use Second Appeal as Pressure, Not Delay

If First Appeal fails:

- File Second Appeal

- Highlight:

- Pattern of denial

- Public interest

- Financial or property impact

Second Appeal works best when:

- RTI questions are document-specific

- Registrar’s inaction is evident

- There is procedural violation

Many cases get resolved before hearing due to departmental pressure.

Strategy 5: Never File Complaint-Style RTI

RTI is not for:

- Allegations

- Accusations

- Explanations

RTI is only for:

- Records

- Files

- Reports

- Orders

A professionally drafted RTI looks neutral, factual, and document-centric. That alone increases success rate by more than 60%.

Frequently Asked Questions (FAQs)

1. Can I file an RTI directly against my housing co-operative society?

In most cases, no. Housing co-operative societies are private bodies and not treated as public authorities under the RTI Act unless they receive substantial government funding or control.

2. Why does RTI against a co-operative society usually get rejected?

RTIs are rejected mainly because the society is not a “public authority,” the RTI is filed to the wrong office, or the applicant asks for internal society records directly.

3. How can I get information from a co-operative society using RTI legally?

You must file RTI indirectly through the Registrar of Co-operative Societies, asking for records held by the Registrar such as audits, inspections, approvals, and complaints.

4. What documents can be obtained through RTI from the Registrar about a co-operative society?

You can obtain audit reports, inspection reports, bye-laws, registration details, complaints filed, action taken reports, election approvals, and regulatory orders.

5. What should I do if the Registrar refuses to provide information under RTI?

You should file a First Appeal within 30 days, clearly pointing out missing documents, improper denial, or violation of RTI timelines and provisions.

6. Can the Registrar deny RTI by saying the information belongs to the society?

No. If the information is held by or submitted to the Registrar in official capacity, it falls under RTI and cannot be denied by shifting responsibility to the society.

7. Is it better to ask for document copies or file inspection in RTI?

If documents are denied, asking for file inspection is often more effective. Inspection cannot be easily refused and helps identify records for certified copies later.

8. What is the biggest mistake people make while filing RTI against co-operative societies?

The biggest mistake is filing complaint-style or emotional RTIs instead of asking for specific documents, records, and action taken reports held by public authorities.

Delayed action, ignored complaint, or missing reply? RTIwala uses RTI to force official accountability and written proof—act now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://cc.rti.link/wadp

🌐 www.rtiwala.com