What Are the Latest EPFO Claim Settlement Rules in India (Updated Guidelines)

The Employees’ Provident Fund Organisation (Employees’ Provident Fund Organisation) has laid down clear claim settlement rules to ensure that PF members receive their money within a defined time. These rules apply to PF withdrawal, pension (EPS), and PF advance claims, whether filed online or offline. Understanding these updated guidelines is crucial because even a small mismatch can legally delay your money.

Under the current rules, EPFO is legally bound to process claims within a fixed timeline once a valid and complete claim is received. The responsibility of accuracy lies on both sides—EPFO officials and the claimant. If documents, KYC, or eligibility conditions are not fulfilled, the claim can be rejected or kept pending without compensation.

Key principles of the latest EPFO claim settlement rules include:

- Claims are processed digitally first, with minimal human intervention

- Aadhaar-based KYC is mandatory for faster settlement

- Employer verification timelines are defined but often misused

- EPFO must provide reasons for rejection or delay on record

These rules exist to protect PF members, but in practice, many claims still face silent delays. Knowing the rule framework helps you identify when EPFO is at fault and when corrective action is justified.

How Many Days Does EPFO Take to Settle PF Claims as per Rules

As per official EPFO guidelines, PF claims must be settled within 20 days from the date of receipt of a complete and valid application. This timeline is not optional—it is a binding administrative rule. The clock starts only when all conditions are fulfilled, which is where most delays occur.

Here is the rule-based settlement timeline explained clearly:

- Online PF claims: 7–20 working days

- Offline/manual claims: Up to 30 days

- Advance (partial withdrawal): Often faster, 7–15 days

- Pension (EPS) claims: Can extend if service records mismatch

If the claim exceeds this timeline without any formal objection or deficiency notice, it is considered an administrative lapse. EPFO officials are required to record the reason internally, even if it is not shown to the member on the portal.

Common stages where days are consumed include:

- Employer digital approval pending

- KYC auto-verification failure

- Service history validation by EPFO office

- Backend scrutiny without status update

Importantly, “under process” is not a legal justification for unlimited delay. Once the prescribed days pass, the claimant has the right to seek accountability.

Delay, ignored reply, or no action? RTIwala uses RTI to force official accountability and written proof.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://cc.rti.link/wadp

🌐 www.rtiwala.com

Rule-Based Difference Between Online and Offline Claim Timelines

The EPFO rules strongly promote online filing because it reduces discretionary delays. Online claims linked with Aadhaar, PAN, and bank account are supposed to move through an automated workflow. Offline claims, however, still depend heavily on manual scrutiny.

As per rules:

- Online claims do not require employer signature if KYC is approved

- Offline claims require physical verification and stamps

- Any mismatch in offline forms resets the timeline

This is why EPFO itself recommends online filing. However, even online claims frequently cross the 20-day limit due to internal pendency, which is a direct violation of settlement norms.

What the Rules Say About “Under Process” or No Status Update

EPFO rules do not recognize “under process” as a permanent status. If a claim remains under process beyond the prescribed period, it indicates one of the following:

- Internal query not communicated to the member

- File pending with dealing assistant or section officer

- Technical flag raised without resolution

In such cases, the rules allow the member to seek written reasons for the delay. EPFO cannot legally withhold settlement without recording deficiencies or objections.

This is where many PF members lose time—they wait indefinitely without invoking their rights. The rule framework is clear, but enforcement requires awareness.

EPFO Claim Settlement Rules for PF Withdrawal, Pension & Advance

The claim settlement rules of the Employees’ Provident Fund Organisation (Employees’ Provident Fund Organisation) differ depending on the type of claim you file. PF final withdrawal, pension (EPS), and PF advance each follow separate eligibility checks, scrutiny levels, and timelines. Many claims get delayed simply because members assume all claims are treated the same, which is not true under EPFO rules.

PF Final Withdrawal – Rule-Based Conditions & Settlement

PF final settlement is allowed only when a member leaves employment and remains unemployed for the prescribed period. As per rules, EPFO verifies service continuity, exit date, and KYC compliance before releasing funds. If any one condition fails, the claim is kept pending or rejected.

Rule-based requirements for PF final withdrawal include:

- Exit date updated by employer in EPFO records

- Aadhaar, PAN, and bank account fully verified

- Minimum unemployment period as per rule

- No overlapping employment linked to the same UAN

As per settlement norms, once these conditions are satisfied, the claim must be processed within 20 days. If EPFO seeks clarification, it must be formally recorded. Silent holding of the claim is a violation of procedure.

Pension (EPS) Claim Settlement Rules

EPS claims are governed by stricter scrutiny because they involve long-term service records. Pension claims are processed only after validating total service years, wage ceiling, and contribution history. Even minor discrepancies can legally pause settlement.

Common rule-based checks in pension claims include:

- Verification of total pensionable service

- Accuracy of Date of Birth across records

- Employer-wise service consolidation

- Eligibility for scheme certificate or pension

Unlike PF withdrawal, pension claims often take longer because records from multiple employers are reviewed. However, delay without communication is not permitted. EPFO must raise objections officially if records are insufficient.

PF Advance / Partial Withdrawal Rules

PF advance claims are designed for urgent financial needs, and rules mandate faster processing. These claims do not require unemployment status but must match the allowed purposes defined by EPFO.

Rule-approved purposes for PF advance include:

- Medical emergency

- Education or marriage

- House purchase or construction

- Natural calamity or disaster

As per rules, advance claims should ideally be settled within 7–15 working days, provided KYC is complete. Rejection can occur only if the reason selected does not match eligibility or service length conditions.

Delay, ignored reply, or no action? RTIwala uses RTI to force official accountability and written proof.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://cc.rti.link/wadp

🌐 www.rtiwala.com

Reasons Why EPFO Claims Get Delayed or Rejected Under Current Rules

EPFO claim delays are rarely random. Almost every delay or rejection falls under a defined rule-based reason, even if EPFO does not clearly disclose it to the member. Understanding these reasons helps you identify whether the delay is valid or unlawful.

Incomplete or Mismatched KYC Records

KYC mismatch is the most common rule-based ground for delay or rejection. EPFO systems automatically flag inconsistencies, and such claims are stopped without manual intervention.

Typical KYC-related issues include:

- Name mismatch between Aadhaar and EPFO records

- Inactive or unverified bank account

- PAN not linked or not validated

- Aadhaar seeded but not approved

Under rules, EPFO cannot process claims until KYC is fully compliant. However, once corrected, the claim must move without restarting the entire timeline.

Employer-Related Delays Under Rules

Although online claims reduce employer involvement, employer actions still impact settlement in many cases. If the employer fails to update exit date or service details, EPFO treats the claim as ineligible.

Rule-triggered employer-related issues include:

- Exit date not updated

- Service period not digitally approved

- Overlapping employment records

- Pending employer clarification requests

Importantly, EPFO rules do not allow indefinite waiting for employer action. If delay persists, EPFO must record the reason officially.

Data Validation & Backend Scrutiny Holds

Even when everything appears correct on the portal, claims may be held during backend validation. These are internal checks, but they are still governed by rules.

Such holds occur due to:

- Duplicate UAN linkage suspicion

- Contribution mismatch across months

- Wage ceiling anomalies

- Historical service record gaps

While scrutiny is permitted, non-communication is not. Rules require that deficiencies be noted internally and communicated when asked.

Rejection Without Proper Reason Disclosure

Many members see claims marked as “rejected” without a clear explanation. As per rules, rejection must be supported by a specific defect or non-compliance. Generic remarks do not fulfill procedural fairness.

Rule-based rejection must include:

- Exact reason for rejection

- Reference to missing or incorrect data

- Scope for correction and reapplication

When this information is not shared, the member has grounds to challenge the action.

Delay, ignored reply, or no action? RTIwala uses RTI to force official accountability and written proof.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://cc.rti.link/wadp

🌐 www.rtiwala.com

Documents & Conditions Required for Faster EPFO Claim Settlement

Under the claim settlement framework of the Employees’ Provident Fund Organisation (Employees’ Provident Fund Organisation), document readiness and rule compliance directly determine how fast your claim is processed. EPFO does not proactively correct errors; it processes only what is compliant at the time of scrutiny.

For faster settlement, the rules implicitly require that all core documents are accurate, verified, and consistent across systems. Even one mismatch can pause the claim without any alert.

Mandatory documents and conditions under rules include:

- Aadhaar fully verified and seeded with UAN

- Bank account active, verified, and in claimant’s name

- PAN linked and validated (mandatory for taxable withdrawals)

- Employer-updated exit date correctly reflecting last working day

In addition, service details such as date of birth, joining date, and name spelling must match across Aadhaar, EPFO, and employer records. Rules do not permit EPFO to “assume” or “auto-correct” discrepancies.

Hidden Rule-Based Conditions Members Often Miss

Many claims are delayed not due to missing documents, but due to rule-linked conditions that are not clearly displayed on the portal. These conditions act as backend filters during scrutiny.

Commonly overlooked conditions include:

- No overlapping employment mapped to the same UAN

- Minimum service period for selected advance reason

- Correct claim form type chosen (final, advance, or pension)

- Wage ceiling and contribution consistency

When these conditions are violated, the claim may remain “under process” indefinitely. As per rules, EPFO must internally record the reason, even if not visible to the member.

EPFO Claim Status Not Updated or Stuck — What the Rules Say

A “claim under process” status does not mean EPFO can hold your claim endlessly. The settlement rules clearly define time limits, and any delay beyond that must be explainable on record.

Rule-based interpretation of stuck claim status:

- “Under process” beyond 20 days indicates administrative delay

- Status without objection means no defect was raised

- Silent pendency is not a recognized rule outcome

EPFO rules do not allow claims to be parked due to internal workload, staff shortage, or technical backlog. Once the prescribed timeline is crossed, the claim moves from “processing” to “delayed” in legal terms.

What EPFO Is Required to Do When a Claim Is Stuck

If a claim cannot be settled within the stipulated time, EPFO officials are expected to:

- Identify the exact bottleneck

- Record the reason internally

- Raise a formal objection if applicable

Failure to do so amounts to procedural lapse. Even though the portal may not reflect this, the obligation exists under administrative rules.

This distinction is crucial because it determines whether escalation is justified or premature.

How to Take Action if EPFO Violates Claim Settlement Rules (RTI & Complaint Options)

When EPFO exceeds settlement timelines or withholds reasons, the law provides structured remedies. These remedies are not emotional escalation—they are rule-based accountability tools.

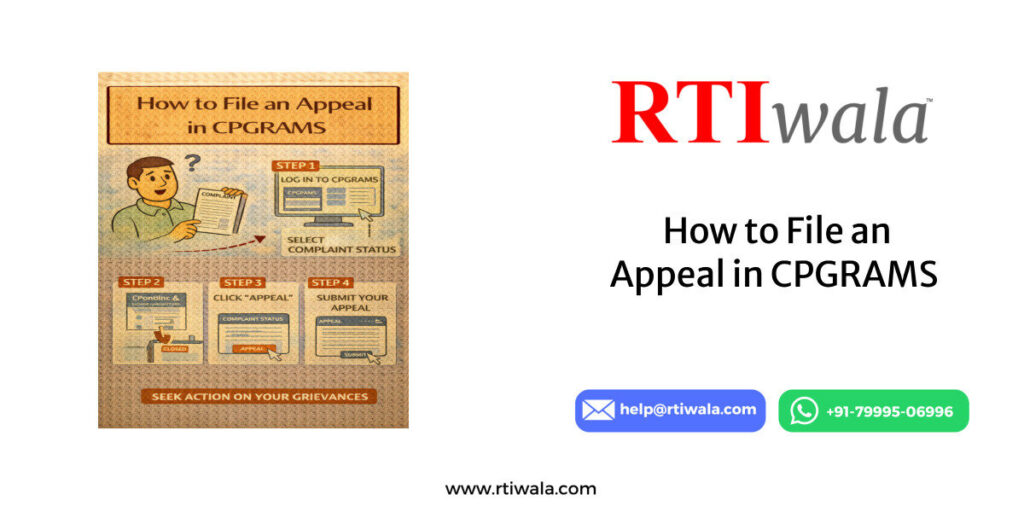

Filing an EPFO Grievance Under Rules

The grievance mechanism allows members to formally report delay, rejection, or non-response. As per procedure, EPFO must respond within a defined period.

Grievance can be raised when:

- Claim exceeds prescribed settlement days

- Rejection reason is unclear or generic

- Status remains unchanged for prolonged period

- Employer-related issues are unresolved

However, grievances often result in templated replies. While useful, they do not always fix accountability.

Using RTI to Enforce Claim Settlement Rules

RTI is the most effective tool when EPFO violates or bypasses its own rules. Through RTI, a member can legally demand written answers backed by records.

RTI can be used to ask:

- Why the claim was not settled within rule timeline

- Which officer handled the claim and on what date

- What defect or rule violation was noted, if any

- Whether any internal noting justifies the delay

Once such questions are asked on record, silent delay becomes legally risky for the department. RTI transforms an invisible delay into a documented accountability issue.

When RTI Becomes Necessary Instead of Waiting

RTI is justified when:

- No response despite grievance

- Claim stuck without objection beyond timeline

- Rejection issued without clear rule reference

- Multiple rejections for the same unresolved reason

At this stage, waiting further only weakens the member’s position. Rules favor time-bound action, not patience without documentation.

Delay, ignored reply, or no action? RTIwala uses RTI to force official accountability and written proof.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://cc.rti.link/wadp

🌐 www.rtiwala.com

Frequently Asked Questions (FAQs) – EPFO Claim Settlement Rules

1. What is the maximum time limit for EPFO claim settlement as per rules?

As per EPFO rules, PF claims must be settled within 20 days from the date a complete and valid claim is received by EPFO.

2. Why does my EPFO claim show “under process” for many days?

A claim remains “under process” due to backend scrutiny, employer pending actions, or data mismatches. Rules do not allow indefinite delays without recorded reasons.

3. Can EPFO legally delay PF claim settlement beyond 20 days?

No. If the delay exceeds prescribed timelines without a formal objection or defect notice, it is considered an administrative lapse under EPFO rules.

4. What are the most common reasons for EPFO claim rejection?

Claims are commonly rejected due to KYC mismatch, exit date not updated, incorrect claim type, PAN issues, or inconsistencies in service records.

5. Are PF advance claims processed faster than final withdrawal?

Yes. PF advance claims are meant for urgent needs and are usually settled within 7–15 working days, provided eligibility and KYC conditions are fulfilled.

6. What documents are mandatory for faster EPFO claim settlement?

Aadhaar-verified UAN, active bank account in the member’s name, PAN (if applicable), and employer-updated exit details are mandatory under settlement rules.

7. What can I do if EPFO does not update my claim status?

If the claim remains stuck beyond timelines, members can file a grievance or use RTI to seek written reasons and officer-level accountability.

8. How does RTI help in delayed or rejected EPFO claims?

RTI allows you to legally ask why the claim was delayed, who handled it, and which rule caused the delay—forcing documented accountability.