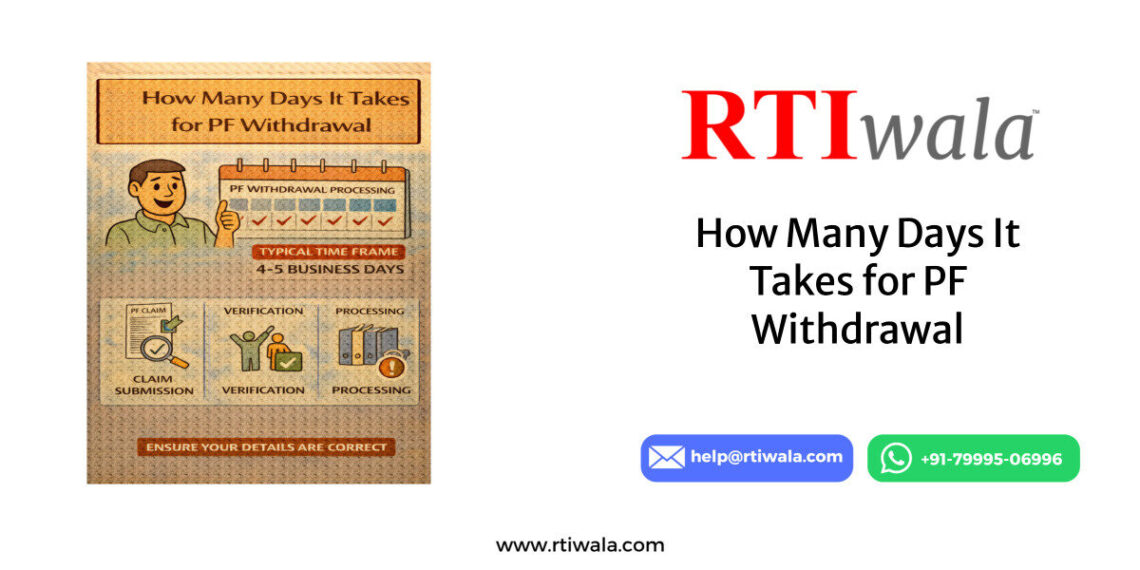

How Many Days Does PF Withdrawal Take as per EPFO Rules

Understanding the PF withdrawal timeline is crucial because delays directly affect your financial planning after job change, retirement, or emergencies. As per rules issued by Employees’ Provident Fund Organisation (EPFO), PF withdrawals are expected to follow a defined time limit once the claim is properly submitted. However, this timeline applies only when all records are correct and verified.

According to EPFO guidelines, a correctly filed PF withdrawal claim should be settled within 20 working days from the date of submission. This includes claim verification, processing, approval, and credit of funds to the bank account. If any mismatch or error exists, the timeline automatically extends without formal notice to the applicant.

Key points to clearly understand EPFO’s official timeline:

- 20 working days is the standard processing limit, not calendar days

- The count starts after claim submission, not after employer exit

- Timeline applies only when KYC, Aadhaar, PAN, and bank details are verified

In real scenarios, many applicants wrongly assume delays mean rejection. In reality, delays usually signal backend verification issues, not denial. EPFO does not proactively inform applicants about internal objections unless the claim status changes visibly on the portal.

It is also important to note that EPFO rules do not guarantee instant settlement, even for urgent cases. The processing strictly depends on record validation across multiple databases. Any discrepancy pauses the workflow silently until corrected.

Situations where EPFO may legally exceed 20 days include:

- Aadhaar–UAN linkage mismatch

- Employer not digitally approving exit details

- Bank IFSC or name mismatch

- PAN not validated for taxable withdrawals

If the PF amount is taxable and PAN is missing or invalid, EPFO may deduct higher TDS or hold processing, which further increases settlement time. This is why “days taken” varies widely among applicants even when claims are filed on the same date.

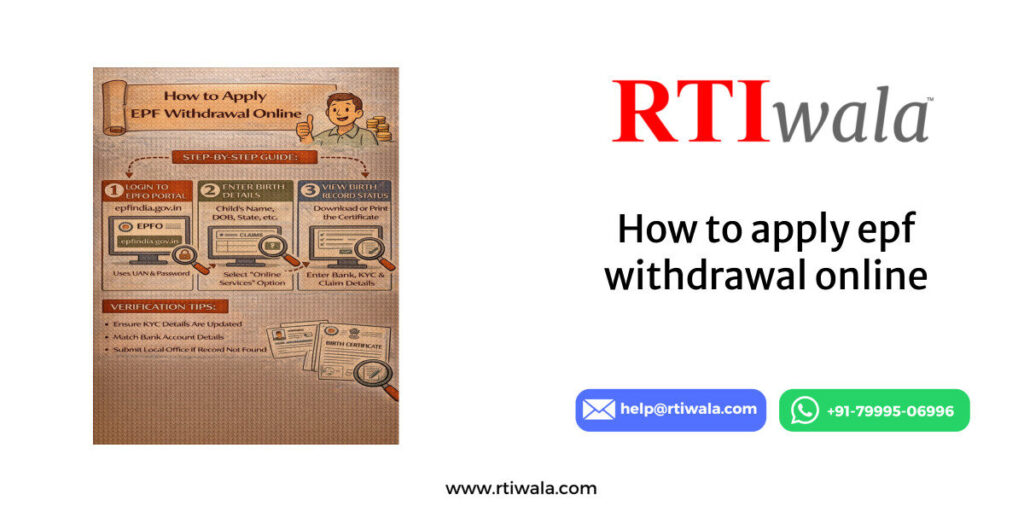

PF Withdrawal Time for Online Claim vs Offline Claim

PF withdrawal time significantly depends on whether the claim is filed online through the EPFO portal or offline via physical forms. EPFO officially encourages online filing because it reduces manual intervention, yet both methods are still in use across India.

For online PF withdrawal claims, the expected settlement time is generally 7 to 15 working days when:

- UAN is active

- Aadhaar is verified

- Employer KYC approval is completed

- Bank details are validated

Online claims move directly into EPFO’s automated processing queue. Since there is minimal human handling, errors are detected faster, and approved claims are credited quicker. In ideal cases, many applicants receive PF money within 7–10 working days.

However, online claims still get delayed if:

- Employer has not approved exit date

- Digital signature verification fails

- Aadhaar authentication errors occur

- Multiple member IDs exist under one UAN

For offline PF withdrawal claims, the processing time is much longer, usually 20 to 45 working days. This is because physical forms must pass through multiple levels, including the employer, local EPFO office, and manual data entry.

Offline claims take longer due to:

- Physical document verification

- Manual data feeding into EPFO systems

- Higher chances of clerical errors

- No real-time status transparency

Another critical difference is visibility. Online claims allow applicants to track each stage digitally, while offline claims often remain “under process” for weeks without clear updates. This lack of transparency creates confusion and stress for applicants.

Comparison summary for clarity:

- Online claim: Faster, trackable, fewer errors, lower rejection risk

- Offline claim: Slower, manual, limited tracking, higher delay probability

Applicants often choose offline filing due to lack of digital awareness or employer guidance, but this choice itself becomes a major reason for prolonged delays. EPFO does not prioritize offline claims over online ones.

PF withdrawal delayed beyond EPFO limits? RTIwala can escalate and resolve it fast.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Why PF Withdrawal Takes Longer Than Expected

PF withdrawal delays are rarely random. In most cases, delays happen because the EPFO system pauses processing when any verification checkpoint fails, even if the claim appears “submitted successfully” to the applicant. The system does not auto-reject; instead, it silently holds the claim until issues are resolved.

The most common reason for delay is employer-side dependency. Even for online claims, EPFO processing depends on whether the employer has correctly updated and approved the employee’s exit details. If the Date of Exit is missing or incorrect, the claim does not move forward.

Major reasons PF withdrawal takes longer than expected:

- Employer has not digitally approved exit or wages

- Aadhaar or PAN verification pending with UIDAI/Income Tax database

- Multiple Member IDs linked to one UAN

- Bank account name not matching Aadhaar records

Another frequent reason is KYC inconsistency. Even a minor spelling mismatch between Aadhaar, bank, and EPFO records can trigger backend objections. These objections are not always shown clearly on the portal, leaving applicants confused about the cause of delay.

Claims involving taxable PF amounts take additional time. If PAN is not linked or validated, EPFO may apply higher TDS or stop processing until compliance is met. This adds extra layers of scrutiny and extends timelines beyond normal limits.

Technical and system-level delays also contribute:

- EPFO server backlogs during peak months

- Manual intervention required at regional offices

- Internal audits or compliance checks

Importantly, delay does not mean rejection. Most delayed PF claims are eventually settled once the underlying issue is corrected. However, without proactive action from the applicant, such claims can remain pending for months.

Understanding the cause of delay is critical, because EPFO does not notify applicants individually. The responsibility to identify and fix issues lies entirely with the PF member.

PF Claim Status Meanings and What Each Status Indicates

Checking PF claim status without understanding its meaning often leads to panic or wrong assumptions. Each status shown on the EPFO portal indicates a specific stage or blockage in the processing workflow, not a final outcome.

When the status shows “Claim Submitted”, it only confirms that the application has been received by the system. It does not mean verification has started. Many claims remain stuck at this stage due to missing employer approvals or KYC validation.

“Under Process” means the claim is currently being examined by EPFO. This stage includes:

- KYC verification

- Employer exit confirmation

- Aadhaar and bank authentication

- Eligibility checks

If a claim remains “Under Process” beyond the normal timeframe, it usually indicates an internal objection or dependency waiting to be resolved.

“Pending with Employer” clearly signals that the employer has not completed required digital actions. Until the employer responds, EPFO cannot legally process or approve the claim.

“Rejected” does not always mean permanent denial. Rejection usually happens due to:

- Incorrect form selection

- Missing documents

- Ineligible claim type

Most rejected claims can be refiled after correction without penalty.

“Settled” means the claim has been approved and the amount has been released. However, bank credit may still take 2–3 working days after this status appears.

Less visible but critical statuses include:

- “Sent for Field Office Review” – manual verification required

- “Awaiting KYC Approval” – Aadhaar/PAN/bank not validated

Applicants often overlook these meanings and wait passively. Knowing what each status actually indicates helps in deciding the next corrective action instead of waiting endlessly.

PF withdrawal delayed beyond EPFO limits? RTIwala can escalate and resolve it fast.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

What to Do If PF Withdrawal Is Delayed Beyond the Time Limit

When PF withdrawal crosses the official time limit, waiting silently does not help. EPFO does not auto-escalate delayed cases. The responsibility lies entirely on the PF member to trigger action through the correct channel, in the correct order.

The first step is to verify the exact delay. Count only working days from the claim submission date shown on the portal. If the claim has crossed 20 working days without settlement or a clear reason, it qualifies as a delay under EPFO norms.

Immediate actions to take when delay exceeds time limit:

- Recheck claim status for hidden dependency messages

- Verify Aadhaar, PAN, and bank KYC approval status

- Confirm employer has approved Date of Exit

If everything is correct and the claim is still stuck, the next step is to raise a grievance with Employees’ Provident Fund Organisation through the EPFiGMS grievance portal. This creates an official record and forces the regional EPFO office to respond within a defined timeframe.

Key points while raising grievance:

- Mention UAN and claim reference number clearly

- State number of days delayed beyond EPFO limit

- Avoid emotional language; stick to facts

If the grievance response is generic or non-resolving, the matter should not be dropped. At this stage, escalation is required because unresolved delays indicate administrative inaction, not technical issues.

A delayed PF claim is not just inconvenience—it is a violation of service timelines. Taking structured action ensures the delay is formally acknowledged and corrected instead of being ignored indefinitely.

How to Speed Up PF Withdrawal and Get Money Faster

Speeding up PF withdrawal is less about shortcuts and more about eliminating system friction before and after filing. Most delays are predictable and preventable if the claim is prepared correctly.

Before filing the claim, ensure all prerequisites are completed:

- Aadhaar seeded and verified with UAN

- Bank account active, verified, and name matched

- PAN linked (mandatory for taxable withdrawals)

- Employer has digitally updated Date of Exit

Filing the correct claim type is equally important. Wrong form selection leads to rejection or manual review, which adds weeks. Always choose the claim option that exactly matches your eligibility status.

After filing, proactive monitoring is critical:

- Check status every 3–4 working days

- Act immediately if status shows employer dependency

- Do not wait for EPFO to notify you

If processing slows down, early grievance filing works faster than waiting. Claims where grievances are raised with proper documentation often move quicker because they enter a monitored resolution queue.

Practical ways applicants successfully reduce delay:

- Ensure single Member ID mapped to UAN

- Avoid offline filing unless absolutely required

- Correct KYC mismatches before filing claim

Speed is achieved not by repeated submissions, but by clean data, correct sequencing, and timely escalation. Once EPFO finds no pending dependency, settlement usually happens without further resistance.

PF withdrawal delayed beyond EPFO limits? RTIwala can escalate and resolve it fast.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Frequently Asked Questions (FAQs)

1. How many days does PF withdrawal actually take as per EPFO rules?

As per Employees’ Provident Fund Organisation (EPFO) rules, a correctly filed PF withdrawal claim should be settled within 20 working days, provided KYC and employer approvals are complete.

2. Is PF withdrawal faster through online claim compared to offline?

Yes. Online PF claims usually settle within 7–15 working days, while offline claims can take 20–45 working days due to manual processing and verification delays.

3. Why is my PF claim still under process for many days?

A PF claim remains “Under Process” mainly due to pending employer approval, KYC mismatch, Aadhaar verification issues, or multiple member IDs linked to one UAN.

4. What does “Pending with Employer” mean in PF claim status?

“Pending with Employer” means your employer has not approved your Date of Exit or claim digitally, and EPFO cannot process the withdrawal until this is completed.

5. Can PF withdrawal be delayed even if all details are correct?

Yes. Even with correct details, delays can occur due to EPFO workload, regional office backlogs, or internal verification checks, though such delays are usually temporary.

6. What should I do if PF withdrawal exceeds 20 working days?

If the claim crosses 20 working days, you should raise an official grievance on the EPFO grievance portal mentioning your UAN and claim reference number.

7. Does rejection of PF claim mean I will not get my money?

No. Most PF claim rejections happen due to correctable errors like wrong form selection or missing KYC. Once corrected, the claim can be refiled without penalty.

8. How can I ensure faster PF withdrawal settlement?

To get PF money faster, ensure Aadhaar, PAN, and bank details are verified, employer exit is approved, correct claim type is selected, and avoid offline filing unless required.

![राशन कार्ड में देरी के लिए आरटीआई आवेदन [सूचना का अधिकार] by RTIwala](https://rtiwala.com/content/wp-content/uploads/2026/01/राशन-कार्ड-में-देरी-के-लिए-आरटीआई-आवेदन-सूचना-का-अधिकार-75x75.jpg)