PF Claim Settled Status Showing but Amount Not Credited – What Does It Mean?

When your PF claim status shows “Settled” on the EPFO portal but the money is not credited to your bank account, it creates confusion and anxiety.

In most cases, “Settled” does not mean money is already received — it only confirms that the claim has been processed by Employees’ Provident Fund Organisation.

The actual fund transfer happens after internal approvals and banking validation, which takes additional time.

So, a settlement status is a procedural confirmation, not the final payment confirmation.

What “PF Claim Settled” actually indicates:

- EPFO has approved your withdrawal request

- Your claim file is closed in the EPFO system

- The payment is queued for bank transfer

- The amount is yet to be credited to your bank account

Many users assume settlement equals instant credit, but EPFO’s backend payment cycle works separately.

If the bank transfer fails or is delayed, the status may still show settled, even though no money is received.

This gap between settlement and credit is the most common reason behind PF withdrawal confusion.

Important point to understand clearly:

- Settlement ≠ Amount credited

- Settlement = Claim approved and forwarded for payment

That’s why checking only the claim status is not enough.

You must track the payment transaction stage separately, which most users are unaware of.

How Many Days After PF Claim Settlement Is Money Credited to Bank Account?

After your PF claim status shows “Settled”, the amount is usually credited to your bank account within 1 to 7 working days.

In ideal cases, the money reflects within 2–3 working days, but delays are common due to system and banking checks.

Weekends, bank holidays, or backend verification can further extend the timeline.

This delay does not automatically mean your money is stuck permanently.

Typical PF credit timeline after settlement:

- Day 0: Claim status changes to Settled

- Day 1–3: Payment file sent to bank

- Day 3–7: Amount credited to bank account

- Beyond 7 days: Delay needs investigation

If 7 working days have passed after settlement and the amount is still not credited, it becomes a valid delay case.

At this stage, waiting silently is risky because unresolved payment failures can remain unnoticed for months.

EPFO does not automatically alert users about failed or pending transfers.

Common delay triggers during this period:

- Bank server or NPCI transaction delay

- Incorrect or inactive bank account mapping

- Payment file stuck at regional EPFO office

- High volume of claims processing

Many users keep refreshing the portal without realizing that post-settlement tracking is not visible directly.

This is why users often feel helpless despite seeing a “Settled” status.

The key is knowing when the delay crosses normal limits and when action is required.

If your PF amount is not credited even after the standard timeline, documentation-based follow-up becomes necessary, which most helplines fail to provide in writing.

PF claim settled but amount not credited? RTIwala forces EPFO to disclose delays and release your PF—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Common Reasons PF Amount Is Not Credited Despite Claim Settlement

When a PF claim is marked “Settled” but the amount is not credited, the issue usually lies after approval, not with the claim itself.

Most failures happen silently at the banking or backend transaction stage, which is not visible on the EPFO dashboard.

This is why users wrongly assume everything is fine while the money is actually stuck.

Understanding these reasons helps you decide when to wait and when to act.

Most common reasons for PF credit failure:

- Incorrect bank account number or IFSC linked with UAN

- Inactive or closed bank account at the time of transfer

- Name mismatch between EPFO records and bank account

- NPCI or bank-side transaction rejection

- Bulk payment file failure at regional EPFO office

Even a minor spelling difference in your name can cause the transaction to fail without notification.

In many cases, the money is reversed internally but the claim status remains “Settled.”

Users are not informed unless they raise a formal complaint or inquiry.

Other less-known but critical reasons:

- Aadhaar seeded but not validated properly

- Employer-related compliance issues flagged post-settlement

- Technical glitches during NEFT/RTGS processing

- High claim volume causing batch-level delays

What makes this worse is that Employees’ Provident Fund Organisation does not auto-reinitiate failed payments.

If the user does not follow up, the amount can remain uncredited for months.

This is why many people believe their PF money is “lost” even though it is actually recoverable.

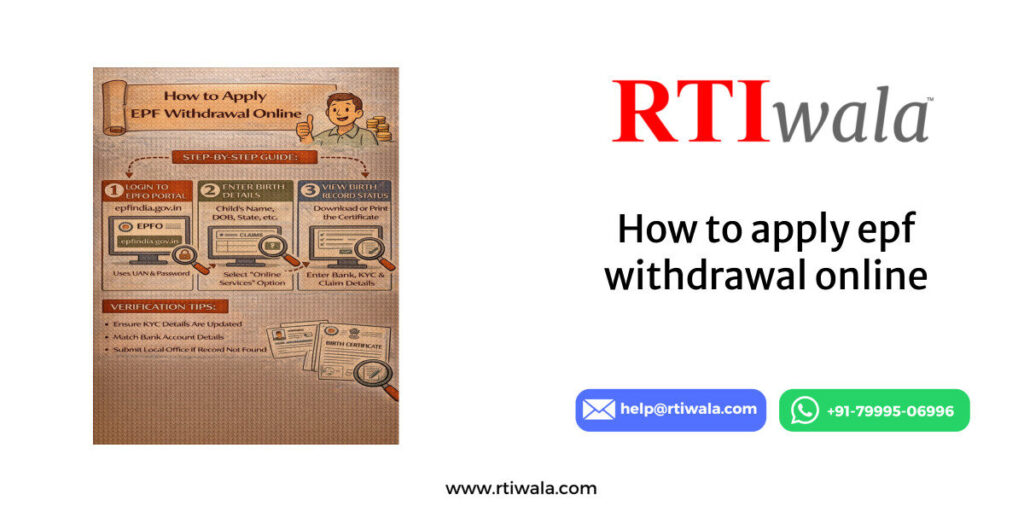

How to Check PF Claim Payment Status and Bank Transaction Details

Checking only the PF claim status is not enough once it shows “Settled.”

To confirm whether money was actually sent to your bank, you must verify the payment transaction details, which most users skip.

This step helps identify whether the delay is on EPFO’s side or the bank’s side.

Without this check, follow-ups become guesswork.

Step-by-step: How to check PF payment status properly

- Log in to EPFO Member Passbook

- Select the relevant UAN and claim entry

- Look for payment or credit remarks

- Check your bank statement for NEFT credit reference

If the amount is initiated, you’ll usually see a transaction reference or narration in your bank account.

If there is no entry at all, it means the payment has not been processed successfully.

This distinction is crucial before raising any complaint.

What different scenarios mean:

- Transaction reference present, no credit → Bank-side delay or rejection

- No transaction reference → EPFO payment not initiated

- Credit reversed → Bank account or IFSC issue

- No data available → Backend processing pending

Users often rely only on the UMANG app or EPFO portal, which does not show bank-level failures clearly.

That’s why checking your actual bank transaction history is mandatory.

If there is no movement even after several days, the issue needs document-backed escalation, not repeated online complaints.

At this stage, written confirmation from EPFO about payment initiation or failure reason becomes important.

Verbal helpline responses do not create accountability or resolution timelines.

This is where many users remain stuck without clarity.

PF claim settled but amount not credited? RTIwala forces EPFO to disclose delays and release your PF—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

What to Do If PF Money Is Not Credited After Settlement Confirmation

If your PF claim shows “Settled” and more than 7 working days have passed without credit, waiting further without action is risky.

At this stage, the delay is no longer “normal processing” and requires structured follow-up.

Most users keep checking the portal repeatedly, but that does not trigger any resolution.

You must move from passive tracking to document-based action.

Immediate actions you should take:

- Re-verify bank account number and IFSC linked with UAN

- Ensure the bank account is active and operational

- Match name spelling between EPFO records and bank account

- Check bank statement for reversal or failed NEFT entry

If all details are correct and still no credit is received, raise a formal grievance instead of calling helplines.

Helpline responses are not recorded officially and do not bind timelines.

A written grievance creates a digital trail and accountability.

Effective follow-up steps:

- File a grievance on EPFO Grievance Portal

- Clearly mention claim ID, settlement date, and non-credit issue

- Attach bank statement showing no credit received

- Save the grievance reference number

Even after raising grievances, many users receive generic replies like “under process” or “please wait.”

If there is no resolution within 15–30 days, the delay becomes unjustified.

At this point, stronger intervention is required to force transparency and action.

Critical mistake to avoid:

- Do not re-submit a fresh claim unless advised officially

- Do not change bank details repeatedly without confirmation

- Do not rely only on emails or calls without written proof

When PF money is stuck despite settlement, the issue is rarely technical alone — it is often administrative inertia.

Breaking this inertia requires asking the right questions in the right legal format.

How RTI Can Help When EPFO Does Not Credit PF Amount on Time

When grievances fail and PF money remains uncredited, RTI becomes the most effective escalation tool.

Unlike complaints, RTI legally obligates Employees’ Provident Fund Organisation to provide written, verifiable answers.

RTI shifts the case from “request” to statutory accountability.

This is why many long-pending PF cases move only after RTI is filed.

What RTI can clearly extract from EPFO:

- Exact date of payment initiation

- Transaction reference / UTR number, if generated

- Reason for non-credit or failed transfer

- Office or official responsible for delay

- Current status of PF amount (pending / reversed / held)

These details are never shared clearly through helplines or generic replies.

RTI forces EPFO to put the facts on record, which often triggers immediate corrective action.

In many cases, PF money gets credited soon after RTI acknowledgment, even before the reply is received.

Why RTI works better than complaints:

- Legal time limit for reply (30 days)

- Written response with official seal

- Accountability of concerned section

- Useful evidence for further escalation, if needed

RTI is especially powerful when:

- PF is settled but unpaid for 30+ days

- Grievances are closed without resolution

- No clarity on payment initiation

- Bank and EPFO blame each other

Once RTI response is received, the user knows exactly where the money is stuck.

This clarity prevents endless follow-ups and protects you from being ignored.

It also creates pressure on officials to resolve the issue quickly.

If you are unsure how to draft or where to file the RTI correctly, professional handling matters, because vague RTIs lead to vague replies.

A well-drafted RTI asks precise, outcome-oriented questions that leave no room for evasion.

PF claim settled but amount not credited? RTIwala forces EPFO to disclose delays and release your PF—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Frequently Asked Questions (FAQs)

1. PF claim status shows settled but money not credited — is this normal?

Yes, it can be normal for 1–7 working days. “Settled” means EPFO approved the claim, not that money is already credited.

2. How long after PF claim settlement does money get credited to bank account?

PF amount is usually credited within 2–7 working days after settlement. Delays beyond this period require follow-up.

3. What are the main reasons PF amount is not credited after settlement?

Common reasons include incorrect bank details, inactive bank account, name mismatch, or EPFO payment processing delays.

4. How can I check whether EPFO has actually sent my PF payment?

Check EPFO passbook and your bank statement for NEFT/RTGS entries. Settlement alone does not confirm payment initiation.

5. What should I do if PF money is not credited even after 7 days?

Re-verify bank details, raise an EPFO grievance with proof, and track the response. Avoid filing a fresh claim.

6. Can PF money get stuck permanently after claim settlement?

No. PF money is not lost, but it can remain stuck due to administrative delays unless followed up properly.

7. How can RTI help if EPFO does not credit PF amount on time?

RTI forces EPFO to disclose payment status, transaction details, and delay reasons in writing, often speeding up resolution.