Why EPF Passbook Is Not Updating or Showing Latest Balance

If your EPF passbook is not updating or showing the latest balance, it usually means the contribution data has not been fully processed at the backend. Even though salary deductions are visible on payslips, EPFO systems update passbooks only after specific validations are completed. This delay is common and does not always mean your money is missing.

The EPF passbook pulls data directly from the Electronic Challan-cum-Return (ECR) filed by your employer. If the ECR is incomplete, incorrect, or pending approval, the passbook will not reflect recent deposits. This is why many users see old balances despite regular monthly deductions.

Another major reason is account linkage issues. If your UAN is not properly linked with the correct Member ID, the passbook may either show partial data or no recent updates at all. This problem is frequently seen after job changes or PF transfers.

Common situations where the EPF passbook does not update:

- Employer has deposited money but ECR is not approved

- Contribution uploaded under a wrong Member ID

- UAN is active but KYC is not verified

- Recent job change without PF transfer completion

- Backend processing delay at Employees’ Provident Fund Organisation

It is important to understand that the EPF passbook is not real-time. Updates depend on employer action, system processing, and internal reconciliations. Panic is common, but the issue is usually procedural.

Common Reasons for EPF Passbook Delay After Contribution

One of the most frequent reasons for EPF passbook delay is late or incorrect filing by the employer. Even if the PF amount is deducted from your salary, the employer must upload correct contribution details and complete payment mapping. Any mistake here directly causes delay.

Another common reason is ECR payment mismatch. Sometimes employers pay the challan amount but fail to correctly link it with employee-wise contribution data. In such cases, EPFO receives money but cannot allocate it to individual accounts, resulting in no passbook update.

Technical and compliance issues also play a big role. If your KYC (Aadhaar, PAN, bank) is pending or rejected, EPFO may withhold updating the passbook until verification is complete. This often goes unnoticed by employees.

Major reasons for EPF passbook delay include:

- Employer filed ECR with errors or incomplete data

- Challan payment done but not mapped correctly

- UAN not seeded with Aadhaar or PAN

- Member ID duplication after job change

- PF transfer from previous employer still pending

- Backend reconciliation pending at EPFO

In some cases, delays extend to several months due to employer non-compliance. Employees usually keep checking the portal, but without internal follow-up, the issue remains unresolved.

If the employer is unresponsive or gives vague answers, the delay becomes a serious concern. At this stage, relying only on the EPFO portal or grievance system may not be enough, because those platforms often show generic responses without accountability.

Understanding these reasons clearly is crucial before taking corrective steps. Most EPF passbook issues are traceable, but they require the right approach and documented follow-up to get fixed.

EPF passbook not updating for months? RTIwala gets clear, written answers from EPFO through RTI—contact us now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

How Long EPFO Takes to Update EPF Passbook Normally

Under normal conditions, EPFO updates the EPF passbook within 5 to 10 working days after the employer successfully files the ECR and the payment is correctly mapped. This timeline applies only when there are no errors, mismatches, or compliance issues at any stage.

However, many employees misunderstand this timeline because salary deduction does not equal passbook update. The EPF system updates balances only after backend validation, not on the salary credit date. This gap often creates confusion and panic.

Typical EPF passbook update timelines:

- 5–10 working days after correct ECR filing

- 10–20 days during month-end or heavy load periods

- 30–60 days if employer corrections are required

- Indefinite delay if employer is non-compliant or data is incorrect

Delays are more common during:

- Financial year-end (March–April)

- Bulk filings by large employers

- PF transfer processing after job change

- Technical upgrades at Employees’ Provident Fund Organisation

If your passbook has not updated even after 30 days, it is no longer considered a normal delay. At that stage, the issue usually involves employer-side errors, pending approvals, or unmapped payments that require intervention.

Key point to remember:

- EPFO does not auto-fix contribution mismatches

- No SMS or email is sent for backend failures

- The burden of follow-up usually falls on the employee

Knowing the realistic timeline helps you decide when to wait and when to escalate, instead of endlessly refreshing the portal without clarity.

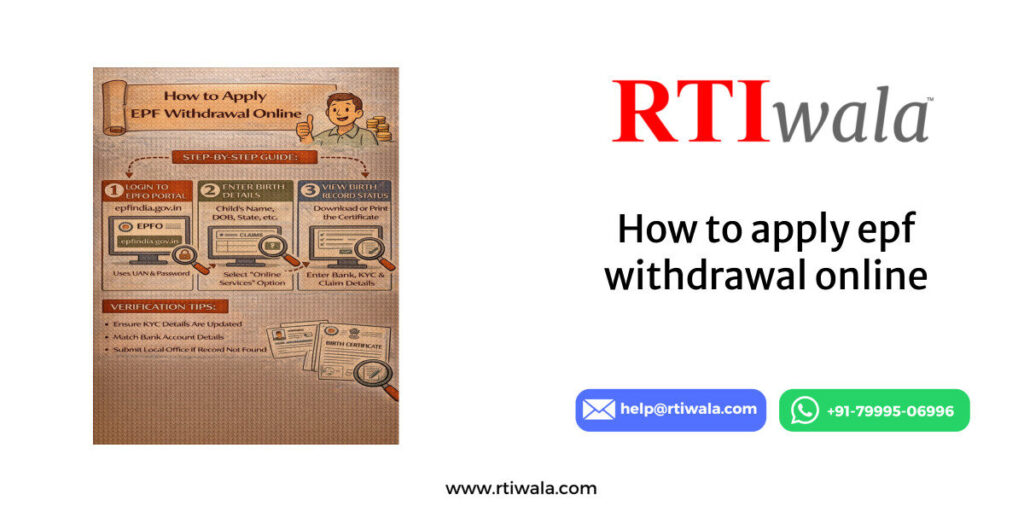

Step-by-Step Checks to Fix EPF Passbook Delay Online

Before escalating or assuming wrongdoing, it is important to perform structured checks online. These steps help identify where exactly the delay is happening—at employer level, UAN level, or EPFO backend.

Step 1: Verify Employer Contribution Status

Log in to the EPF Member Passbook portal and check whether the month-wise contribution entry exists. If a month is missing entirely, it usually means the employer has not filed or corrected the ECR.

What to check:

- Missing months

- Zero contribution shown despite salary deduction

- Employer name mismatch

Step 2: Check UAN KYC Status

An unverified or rejected KYC can block updates silently. Visit the UAN Member Portal and ensure:

- Aadhaar is verified

- PAN status shows approved

- Bank details are validated

Incomplete KYC is one of the most ignored reasons for long delays.

Step 3: Confirm Correct Member ID Mapping

After switching jobs, many users unknowingly end up with:

- Multiple Member IDs

- Contributions credited to an old ID

- Transfer request stuck or not initiated

Ensure your current employer is contributing under the active Member ID linked to your UAN.

Step 4: Check PF Transfer Status (If Applicable)

If you recently changed jobs, check whether the PF transfer is approved and settled. Until transfer completion, balances may not reflect properly in the passbook.

Common transfer-related issues:

- Employer approval pending

- Old employer did not digitally sign

- Transfer request rejected silently

Step 5: Review EPFO Grievance History

If you have already raised complaints, check the response carefully. Many grievances are closed with generic replies without actual resolution.

Red flags in grievance replies:

- “Under process” for months

- No reference to specific contribution months

- No documentary explanation

These online checks help you identify the problem area. However, if the delay persists despite all checks being clear, the issue usually lies inside EPFO records or employer filings, where standard portals stop giving meaningful answers.

At this stage, stronger and more targeted action becomes necessary—something that normal online tools often fail to provide.

EPF passbook not updating for months? RTIwala gets clear, written answers from EPFO through RTI—contact us now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

What to Do If EPF Passbook Is Delayed for Months

If your EPF passbook has not updated for more than 2–3 months, it is no longer a routine delay. At this stage, the issue is usually systemic—either due to employer non-compliance, backend reconciliation failure, or unmapped contributions within EPFO records.

The first critical step is to stop relying only on passbook refresh or generic grievance replies. Month-long delays indicate that your contribution data is stuck at a specific processing stage and will not resolve automatically without targeted intervention.

Immediate actions you must take:

- Collect salary slips showing PF deductions for missing months

- Take screenshots of passbook showing non-updated entries

- Note employer ECR filing months and challan payment dates

- Preserve grievance reference numbers (if already raised)

If your employer is unresponsive or provides verbal assurances without proof, the risk increases. Many employees later discover that contributions were paid but not correctly mapped, or worse, never deposited despite deductions.

Warning signs that require escalation:

- Employer avoids written confirmation

- Same grievance response repeated for weeks

- “Under process” status beyond 45 days

- No clarity on missing contribution months

At this stage, filing repeated grievances often leads nowhere. EPFO systems typically close complaints without explaining where exactly the contribution is stuck—employer upload, EPFO validation, or internal reconciliation.

This is where formal accountability becomes necessary, because delays beyond months can directly impact:

- PF withdrawal eligibility

- Interest calculation

- Transfer accuracy during job change

- Pension (EPS) credit records

Without documented answers, employees remain stuck in uncertainty, even though the money may technically exist somewhere in the system.

How RTI Helps to Get Clear Answers from EPFO on Passbook Delay

When EPF passbook delays extend for months and informal channels fail, the Right to Information (RTI) Act becomes the most effective tool. RTI legally compels the public authority to provide written, record-based answers, not generic explanations.

An RTI filed with Employees’ Provident Fund Organisation forces officials to check actual records instead of issuing template replies. This is often the first time employees receive clarity on what truly happened to their contributions.

Through RTI, you can seek:

- Month-wise contribution receipt status

- Employer ECR filing and acceptance details

- Challan mapping confirmation for each month

- Reasons for non-updating of passbook entries

- Current processing stage and responsible office

Unlike grievances, RTI replies are:

- Time-bound (30 days)

- Legally accountable

- Document-based

- Useful as evidence for escalation

In many cases, RTI responses reveal:

- Employer uploaded incorrect data

- EPFO failed to reconcile challan payments

- Contributions credited to wrong Member ID

- Manual correction pending without action

Once this information is in writing, resolution becomes faster because:

- Employer accountability increases

- EPFO cannot deny record existence

- Further escalation becomes evidence-based

Most importantly, RTI eliminates uncertainty. You stop guessing and start acting with clarity—whether that means pushing the employer, demanding correction, or escalating within EPFO with proof.

EPF passbook not updating for months? RTIwala gets clear, written answers from EPFO through RTI—contact us now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Frequently Asked Questions (FAQs)

1. Why is my EPF passbook not showing the latest contribution even after salary deduction?

EPF passbook updates only after the employer files correct ECR and EPFO completes backend validation. Salary deduction alone does not trigger passbook updates.

2. How many days does EPFO normally take to update the EPF passbook?

Under normal conditions, EPFO updates the EPF passbook within 5–10 working days after successful ECR filing and challan mapping by the employer.

3. Can EPF passbook delay happen even if the employer has paid PF on time?

Yes. Passbook delays can occur due to incorrect ECR data, challan mismatch, wrong Member ID mapping, or pending verification at Employees’ Provident Fund Organisation.

4. What should I do if my EPF passbook has not updated for more than 2 months?

If the delay exceeds 2 months, collect salary slips and passbook screenshots, check KYC and Member ID status, and escalate the issue formally instead of waiting.

5. Does unverified KYC cause EPF passbook update delay?

Yes. If Aadhaar, PAN, or bank KYC is unverified or rejected, EPFO may block contribution updates without showing any visible error.

6. Will raising an EPFO grievance fix EPF passbook delay?

Grievances often receive generic replies and may not resolve backend issues. If delays persist, stronger action is required to get record-based answers.

7. How does RTI help in resolving EPF passbook delay issues?

RTI forces EPFO to provide written, month-wise contribution status, ECR details, and reasons for delay, making it easier to fix employer or EPFO-side issues.