PF Claim Settled but Amount Not Credited – What Does It Actually Mean?

When the PF claim status shows “Settled” but the money has not reached the bank account, it means the claim approval process is complete, not that the payment is already credited. Many PF applicants misunderstand this status and assume instant credit, which is not always the case.

In EPFO systems, “Settled” indicates that the claim has passed internal verification and the payment instruction has been generated. However, the actual transfer depends on banking systems, treasury processing, and correct beneficiary details.

What “PF Claim Settled” practically means:

- EPFO has approved the withdrawal request

- Payment file has been prepared

- Amount is queued for bank transfer

- Credit may still be pending at bank or treasury level

At this stage, EPFO’s role is partially complete, but the money is not yet guaranteed in your account. A delay here is common and does not always mean rejection or fraud.

Key realities most people are not told:

- Settlement ≠ instant credit

- Settlement date ≠ payment date

- Bank processing happens after EPFO clearance

- Errors surface only at payment stage

This is exactly why many people panic despite seeing a “Settled” status. The system is not transparent about post-settlement delays, leaving PF members confused.

If the amount is not credited after settlement, the issue usually lies in bank verification, payment batch delay, or backend processing, not in the claim approval itself.

How Long Does It Take for PF Money to Reach the Bank After Settlement?

After a PF claim is marked as “Settled,” the standard credit timeline is 1 to 7 working days. In many cases, the money reaches the account within 2–3 working days, but delays beyond this window are not uncommon.

The delay depends on multiple backend factors involving EPFO, treasury systems, and the bank. Even if everything is correct, public holidays and batch processing can slow down the transfer.

Typical PF credit timelines after settlement:

- Same day to 2 days → Fast-track cases

- 3–5 working days → Normal processing

- 6–7 working days → Minor backend delay

- 7+ days → Needs attention or escalation

Several users experience longer delays during:

- Month-end or financial year closing

- High claim volume periods

- Bank server or NEFT processing issues

Important things to understand about delays:

- EPFO releases payments in batches, not instantly

- Banks may hold payments for verification

- Weekends and holidays pause credit cycles

- SMS alerts may arrive after credit, not before

If 7 working days have passed since the settlement date and there is still no credit, the delay should no longer be considered normal. This is the point where proactive checking becomes essential.

At this stage, blindly waiting rarely helps. The next steps should focus on verifying bank details, checking payment status, and identifying where the money is stuck—whether with the bank or EPFO.

PF claim settled but money not credited? RTIwala traces EPFO payment delays and fixes them fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

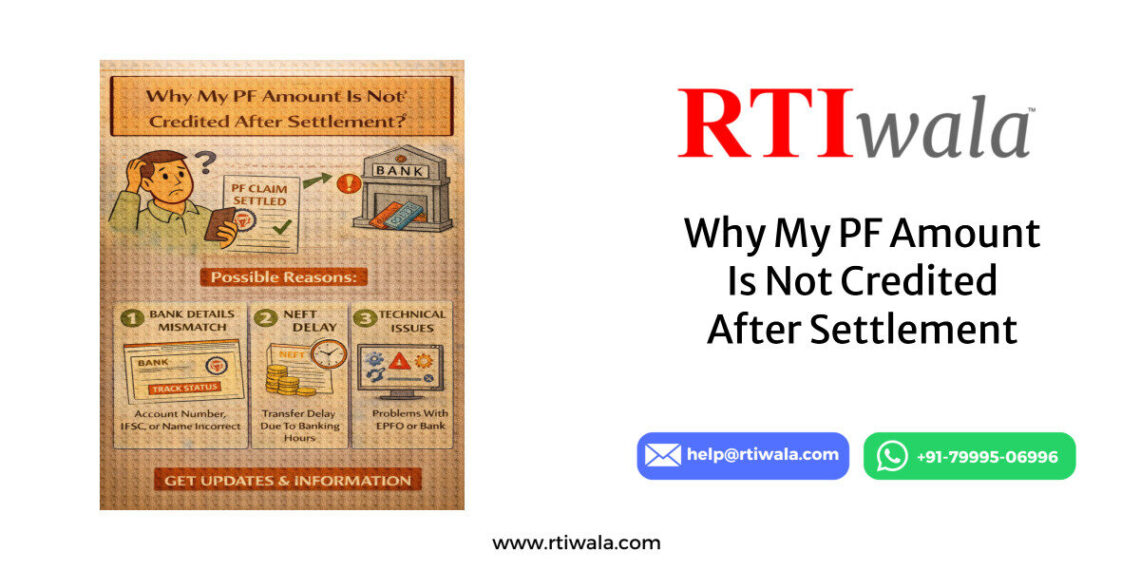

Common Reasons PF Amount Is Not Credited After Settlement Status

When a PF claim is settled but the amount is still not credited, the reason is almost always post-settlement failure, not rejection. These failures happen after EPFO approval, during payment routing, bank validation, or treasury processing.

Most PF applicants never receive a clear explanation because the EPFO portal does not show payment-level errors. Understanding these common causes helps identify where the money is actually stuck.

Most frequent reasons for PF credit delay after settlement:

- Incorrect or inactive bank account number

- IFSC code mismatch or branch merger changes

- Name mismatch between PF records and bank account

- Bank account not linked to Aadhaar/KYC properly

Even a minor spelling mismatch (extra initial, missing surname, spacing error) can cause the bank to silently reject or hold the payment without notifying the PF member.

Backend and system-related causes many users face:

- Payment file rejected by bank server

- NEFT/RTGS batch failure on processing day

- Treasury authorization pending

- High-volume settlement days causing backlog

In such cases, EPFO marks the claim as settled, but the payment is stuck in “processed but not credited” state, which is not visible to the user.

Less-known but critical reasons:

- Bank account closed or dormant

- Joint account restrictions at bank level

- Zero-balance accounts flagged for verification

- Recent bank KYC updates not synced

This is why many PF members wait for weeks without clarity. The system assumes the user will figure it out, while the user assumes EPFO will auto-resolve it.

If no credit is received within 7 working days, it is no longer a “normal delay.” It indicates a specific failure point that must be identified through verification.

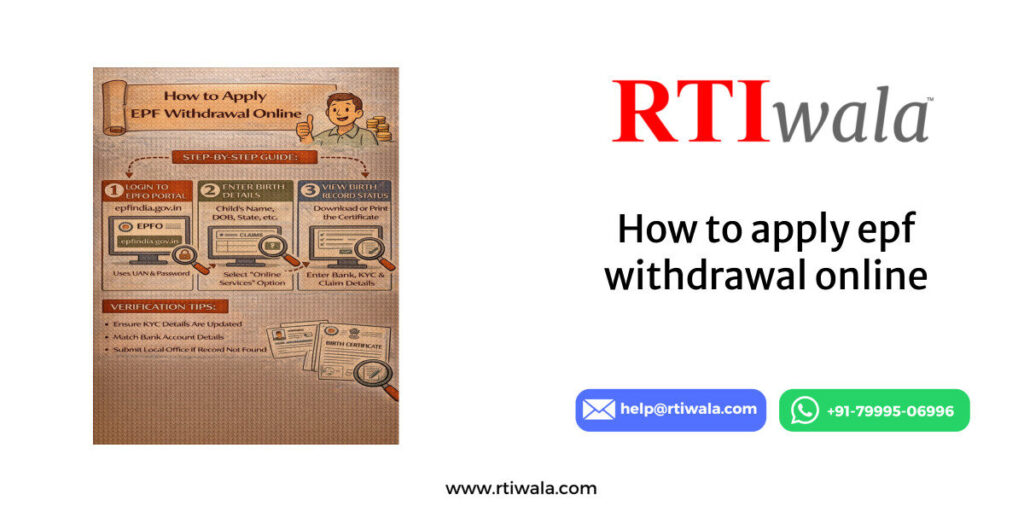

How to Check PF Bank Account Details and Payment Status Correctly

Before raising complaints or escalating, the first and most important step is verifying whether the payment was actually released and whether your bank details are error-free. This avoids unnecessary delays and incorrect follow-ups.

Start by logging into the Employees’ Provident Fund Organisation Member Portal and checking the claim details carefully.

Step 1: Verify settlement date and payment remarks

- Open the PF claim status page

- Note the exact settlement date

- Check if any remarks or payment reference is visible

- Take screenshots for records

The settlement date is your reference point for calculating delay. All further action depends on this date.

Step 2: Cross-check bank account details in PF records

- Account number (no extra or missing digits)

- IFSC code (updated branch code only)

- Name exactly as per bank records

- Account status (active, not dormant)

Even if the details were correct earlier, bank mergers or IFSC changes can silently invalidate old records.

Step 3: Check passbook and bank SMS history

- Review transaction history from settlement date

- Look for reversed or failed credits

- Check spam or blocked SMS alerts

- Contact bank branch if needed

Banks sometimes receive the payment but hold it for verification, especially if name or KYC details differ.

Step 4: Check PF passbook for debit entry

- Login to PF passbook

- See if withdrawal amount is debited

- Note transaction or reference number

A debit entry without bank credit usually means payment left EPFO but did not reach your account, which is a critical signal.

Step 5: Confirm Aadhaar and KYC linkage

- Aadhaar verified and active

- Bank KYC completed

- No pending verification flags

Incomplete KYC can cause payments to be blocked even after settlement.

What not to do at this stage:

- Do not reapply for PF withdrawal

- Do not change bank details blindly

- Do not wait endlessly without tracking

Correct verification helps determine whether the delay is caused by EPFO processing, bank validation, or technical failure. Only after this clarity should escalation begin.

PF claim settled but money not credited? RTIwala traces EPFO payment delays and fixes them fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

What to Do If PF Amount Is Still Not Credited After Many Days

If 7–10 working days have passed after PF claim settlement and the amount is still not credited, waiting silently is no longer a solution. At this stage, the delay is considered abnormal, and the responsibility shifts to EPFO and the bank to provide a clear explanation.

The biggest mistake PF members make is assuming the system will auto-fix the issue. In reality, unresolved PF payment failures often remain stuck indefinitely unless the member takes structured action.

Immediate actions to take once delay crosses 7 working days:

- Recheck PF settlement date and reference number

- Verify bank account status directly with branch

- Confirm no reversal or hold is applied by the bank

- Keep screenshots of PF status and passbook entries

This documentation becomes critical for escalation. Without proof, complaints often get closed with generic replies.

Next, raise an official grievance instead of informal follow-ups.

Calling helplines or sending emails rarely creates accountability because there is no tracking obligation.

What usually happens if you do nothing:

- Payment remains stuck in backend queue

- No auto-alert is triggered

- Claim shows “Settled” permanently

- No written explanation is issued

This is why structured escalation is necessary. The goal is not just to receive money, but to force EPFO to identify where the payment failed and reprocess it.

At this stage, reapplying for PF withdrawal is risky and often leads to duplicate claim rejection. The focus must remain on resolving the existing settled claim.

When and How to Escalate PF Credit Delay to EPFO (RTI & Complaint Options)

If informal checks do not resolve the issue, formal escalation becomes the most effective and legally backed option. This is where many PF members finally get clarity after weeks of confusion.

Step 1: File an EPFO Grievance (Mandatory First Step)

Raising an official grievance creates a ticketed record that EPFO is obligated to respond to within a fixed timeframe.

What to clearly mention in the grievance:

- PF claim number and settlement date

- Number of days since settlement

- Confirmation that bank details are correct

- Request for payment reference or reprocessing status

Avoid emotional language. Stick to facts and timelines. A factual grievance is harder to ignore or close casually.

However, many grievances receive generic replies like “payment under process” without actual resolution. If this happens, escalation must continue.

Step 2: Use RTI to Force Written Accountability (Most Effective)

When grievances fail or responses are vague, filing an RTI is the strongest escalation tool. RTI legally compels the authority to provide specific, record-based answers instead of generic assurances.

Through RTI, PF members can ask:

- Whether payment instruction was issued

- Date of fund transfer initiation

- Payment mode and transaction reference

- Reason for non-credit or failure

- Whether reprocessing has been approved

This shifts the burden of explanation to Employees’ Provident Fund Organisation, making delays traceable and documented.

Why RTI works when complaints don’t:

- RTI responses are legally binding

- False or vague replies invite penalties

- Officers must consult records before replying

- Creates written evidence for future action

In many cases, PF amounts get credited soon after RTI filing, because unresolved payment failures come under internal scrutiny.

Step 3: Escalate to Higher Authorities If Needed

If RTI confirms payment failure or negligence, the matter can be escalated further using:

- RTI reply as supporting evidence

- Follow-up grievance citing RTI findings

- Regional EPFO office escalation

This structured path ensures the issue moves forward instead of looping endlessly.

What to Avoid During Escalation

- Do not file multiple vague grievances

- Do not rely only on call center assurances

- Do not submit duplicate withdrawal claims

- Do not change bank details repeatedly

Unstructured actions often reset the process instead of resolving it.

PF claim settled but money not credited? RTIwala traces EPFO payment delays and fixes them fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

FAQs: PF Claim Settled but Amount Not Credited

1. PF claim settled but money not credited — is my payment approved or pending?

Yes, the claim is approved. “Settled” means EPFO has processed and approved the claim, but the bank transfer may still be pending due to backend or banking delays.

2. How many days after PF claim settlement should I wait for bank credit?

Normally, PF money is credited within 1 to 7 working days after settlement. If it exceeds 7 working days, the delay is considered abnormal and needs verification or escalation.

3. Can PF amount fail after settlement due to bank issues?

Yes. Common bank-side issues include wrong IFSC, inactive account, name mismatch, dormant account, or KYC problems, which can silently block or reject the credit.

4. How can I check whether EPFO has actually released my PF payment?

Check the PF passbook for debit entry and verify bank statements from the settlement date. A debit without credit usually means the payment left EPFO but failed at bank or treasury level under Employees’ Provident Fund Organisation processing.

5. Should I reapply for PF withdrawal if money is not credited after settlement?

No. Reapplying can cause duplicate claim rejection and further delay. Always resolve the existing settled claim through verification, grievance, or RTI.

6. When should I file an EPFO grievance for PF credit delay?

File a grievance if 7 working days have passed after settlement and there is no credit or clear explanation. Grievance creates an official, trackable record.

7. How does RTI help in PF claim settled but not credited cases?

RTI forces EPFO to provide record-based answers like payment initiation date, transaction reference, and failure reason. In many cases, PF credit happens soon after RTI filing due to internal accountability.