Why Is My PF Claim Delayed Even After Submission?

A PF claim delay usually happens after submission but before internal processing, and most delays are caused by verification or compliance gaps—not system failure. Even if your claim shows “Submitted,” it does not mean it has entered the payment stage.

Common real reasons for PF claim delay include:

- KYC mismatch (Aadhaar, PAN, or bank account not verified)

- Employer approval pending or digitally rejected

- Incorrect exit date updated by the employer

- Name or DOB mismatch between Aadhaar and EPFO records

- Multiple UANs linked to one employee

Each of these issues automatically halts processing at the backend level inside Employees’ Provident Fund Organisation systems, even though the portal shows no visible error.

Another major reason for delay is manual scrutiny. Claims involving higher amounts, past employer disputes, or partial withdrawals often go through additional officer-level checks, increasing processing time beyond the normal window.

Delays also occur when:

- Employer is non-responsive or marked inactive

- Past transfer-in claims are still pending

- Bank account is inactive or wrongly linked

- Claim was filed during high-volume periods (month-end or financial year-end)

Important to understand:

EPFO does not proactively notify applicants about internal objections. Unless you actively check the claim remarks or grievance status, the delay continues silently.

If your claim has crossed 10–15 working days without movement, it is no longer a “normal delay”—it indicates a processing block that needs action, not waiting.

How Many Days Does EPFO Take to Settle a PF Claim?

As per EPFO’s internal service standards, a PF claim should be settled within a fixed time frame, provided all details are correct and verified.

Official EPFO Processing Timelines

- Online PF Withdrawal / Final Settlement: 7–10 working days

- Partial PF Advance: 3–7 working days

- PF Transfer Claims: 10–20 working days

- Pension (EPS) Claims: 15–30 working days

These timelines start only after:

- KYC is fully verified

- Employer approval (if required) is completed

- Claim passes initial validation checks

If any verification fails, the claim automatically exits the standard timeline and enters a pending queue—without updating the user clearly.

What “Under Process” Really Means

When your PF claim status shows “Under Process”, it can mean multiple backend stages, such as:

- Initial data validation

- Officer allocation

- Employer confirmation review

- Payment authorization

- Bank file generation

A claim can remain stuck at any one stage without visible updates on the portal.

PF claim delayed or settled but not credited? RTIwala resolves EPFO delays through grievance & RTI—act now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

When a Delay Becomes a Violation

Your PF claim delay becomes actionable if:

- No update after 10 working days for withdrawal

- No settlement after 15 days for online claims

- “Under Process” status remains unchanged for 7+ days

- Claim shows “Settled” but amount not credited within 3 working days

At this stage, waiting further does not help. EPFO does not auto-escalate delayed claims unless a grievance or formal intervention is initiated.

How to Check PF Claim Delay Status Online

Checking PF claim delay status correctly is critical because the default status shown to users is incomplete. Many applicants assume “Under Process” means active work, but in reality, the claim may be stuck at a specific backend stage.

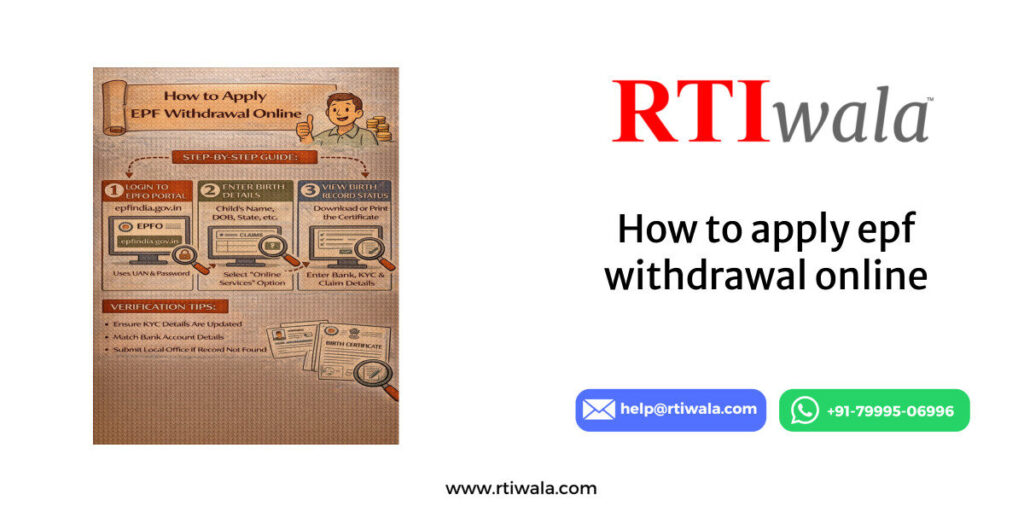

Step-by-Step: Correct Way to Check PF Claim Delay Status

To get accurate clarity, follow all checks, not just one:

- Visit the EPFO Member Portal

- Log in using UAN + OTP

- Navigate to Online Services → Track Claim Status

- Select the relevant claim ID

- Note the remarks column, not just the status

If remarks are blank or unchanged for days, it usually indicates no officer-level movement.

Additional Checks Most Users Miss

A proper delay diagnosis requires cross-verification from multiple sources:

- Passbook check to confirm if payment file was generated

- Bank SMS/email alerts for failed or reversed credits

- KYC verification section to reconfirm Aadhaar/PAN status

- Employer approval status under “Manage → Member Profile”

If KYC shows “Verified” but claim is pending, the delay is not user-side—it’s administrative.

What Each Claim Status Actually Indicates

Many users misinterpret EPFO terms. Here’s what they really mean:

- Under Process: Claim received but not authorized

- Pending with Employer: Employer approval awaited

- Rejected: Claim closed due to discrepancy (reason often hidden)

- Settled: Payment authorized (not necessarily credited)

- Payment Failed: Bank or IFSC-related issue

Understanding this difference helps decide when to escalate instead of waiting.

Red Flags That Confirm a Delay Problem

You should treat your PF claim as delayed if:

- Status unchanged for 7+ working days

- “Under Process” shows no remarks

- Employer approval pending despite follow-up

- Claim marked “Settled” but no credit after 3 days

- No communication from Employees’ Provident Fund Organisation

At this point, passive tracking is useless—intervention is required.

PF claim delayed or settled but not credited? RTIwala resolves EPFO delays through grievance & RTI—act now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

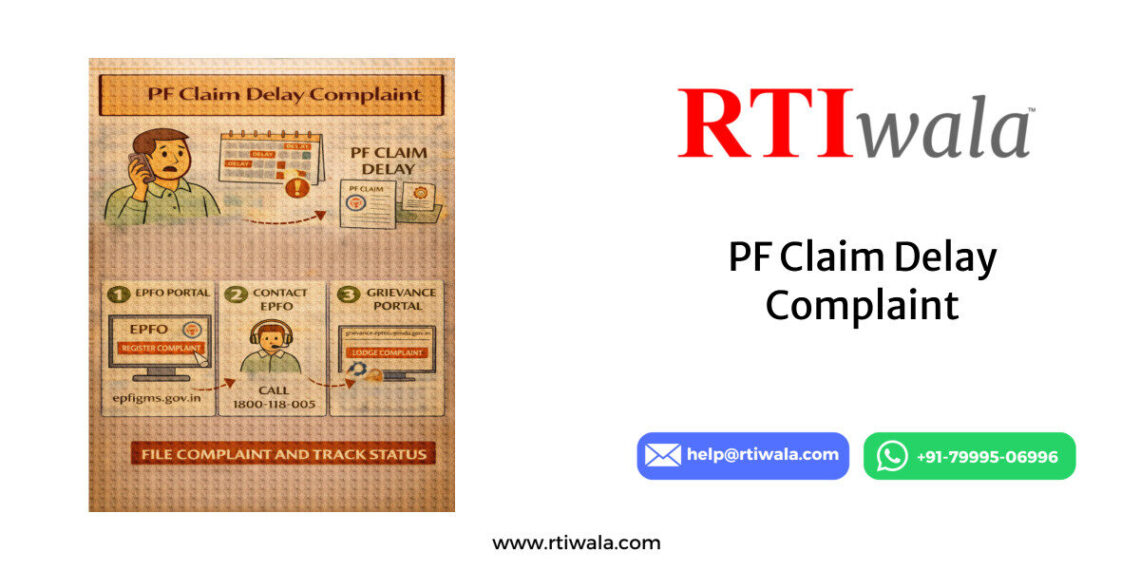

How to File a Complaint for PF Claim Delay with EPFO

Once delay indicators are confirmed, filing a complaint is the only effective way to trigger internal accountability. EPFO does not auto-resolve delayed claims without a formal grievance.

Step-by-Step: Filing EPFO Grievance Correctly

Follow this exact sequence to avoid rejection:

- Visit EPFiGMS (EPFO Grievance Portal)

- Select PF Member category

- Enter UAN, registered mobile, and OTP

- Choose grievance type: PF Withdrawal / Settlement Delay

- Clearly mention claim ID and delay duration

Avoid emotional language—use factual, date-based statements only.

What to Write in the Complaint (Critical)

Your grievance should clearly state:

- Claim submission date

- Current status and number of days pending

- Confirmation that KYC is verified

- Mention of no response or remarks

- Request for immediate processing or written reason

Complaints lacking specifics are often auto-closed without action.

EPFO Complaint Resolution Timeline

After submission:

- EPFO is required to respond within 15 working days

- Response may include clarification, action taken, or generic closure

- If resolved, status updates appear in claim tracking

- If closed without resolution, escalation becomes valid

Many cases get resolved only after grievance filing, proving that delays are often due to inaction—not errors.

Common Reasons EPFO Complaints Get Ignored

Grievances fail when:

- Claim ID is missing

- Issue category is wrongly selected

- Vague statements like “please process fast”

- Multiple grievances filed without waiting period

- Employer-related delays not clearly mentioned

One well-drafted complaint is more effective than multiple follow-ups.

PF Claim Settled but Amount Not Credited – What to Do?

When a PF claim shows “Settled” but the amount is not credited, it creates confusion because “settled” only means payment authorization, not successful transfer. The actual credit happens after bank-side and file-level validations.

Immediate Checks to Do (Within 24–72 Hours)

Before escalating, complete these checks in order:

- Wait up to 3 working days after “Settled” status

- Check bank SMS/email for failed or reversed credits

- Verify bank account number & IFSC linked with UAN

- Confirm the account is active and not dormant

- Recheck EPFO passbook for debit entry date

If no credit reflects after 3 working days, it indicates a payment execution issue, not a processing delay.

Most Common Reasons for Non-Credit After Settlement

These issues are frequently responsible:

- Wrong IFSC or bank branch merged/renamed

- Name mismatch between EPFO and bank records

- Dormant or closed bank account

- Bank-side rejection of NEFT file

- Payment file error during batch processing

In such cases, EPFO marks the claim as settled, but the bank returns or blocks the transfer silently.

What Happens in the Backend (Important Insight)

Once authorized, EPFO sends a bulk payment file to the bank. If your transaction fails inside that file:

- The portal does not auto-update failure instantly

- No alert is sent to the member

- Money remains with EPFO until reprocessing

- Manual intervention is required to re-initiate payment

This is why users see “Settled” without receiving funds—even after weeks.

Correct Action Steps if Amount Is Not Credited

If 3 working days have passed:

- Raise a grievance mentioning “Settled but Not Credited”

- Attach bank proof (account active confirmation)

- Mention settlement date and claim ID

- Request re-issue of payment or failure reason in writing

Do not submit a new claim—this can complicate reconciliation.

If the issue persists, it becomes a payment negligence case, eligible for escalation.

PF claim delayed or settled but not credited? RTIwala resolves EPFO delays through grievance & RTI—act now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

When and How to Escalate PF Claim Delay Through Grievance or RTI

Escalation is not about pressure—it’s about triggering accountability when timelines are violated or information is withheld.

When Escalation Becomes Mandatory

You should escalate if:

- Claim delayed beyond official timelines

- Grievance closed without resolution

- “Settled” but amount not credited after 3 days

- No written reason provided for delay

- Repeated follow-ups ignored by Employees’ Provident Fund Organisation

At this stage, normal complaints stop working.

First Level: Structured Grievance Escalation

Before RTI, ensure:

- One clear, factual grievance is filed

- 15 working days have passed

- Closure remarks are generic or non-actionable

If EPFO fails to provide a reasoned response, escalation is justified.

Second Level: Escalation Through RTI (Most Effective)

RTI is used not to request processing, but to seek accountability records. Properly framed RTI questions force EPFO to act.

RTI can legally ask for:

- Officer responsible for claim delay

- Date-wise movement of the claim file

- Reason for non-credit after settlement

- Internal notes or objections recorded

- Action taken on grievance number

Once RTI is filed, departments usually resolve the issue quickly to avoid documented liability.

Why RTI Works When Grievances Fail

- RTI has statutory deadlines

- False replies attract penalties

- Officer names are disclosed

- File movement becomes traceable

- Delays turn into recorded negligence

Most long-pending PF issues get resolved after RTI intervention, not reminders.

What Not to Do During Escalation

Avoid these mistakes:

- Filing multiple RTIs without strategy

- Emotional or accusatory language

- Asking “why delay” without specifics

- Submitting RTI before grievance maturity

- Re-filing claims instead of escalating

Escalation works only when it’s procedural, precise, and documented.

FAQs:PF Claim Delay Complaint

1. Why is my PF claim still under process for many days?

A PF claim stays “under process” when backend verification is pending due to KYC mismatch, employer approval delay, or manual scrutiny by Employees’ Provident Fund Organisation. If unchanged for 7+ working days, it indicates a processing block.

2. How many days does EPFO legally take to settle a PF claim?

EPFO generally settles online PF withdrawal claims within 7–10 working days after complete verification. Delays beyond this period require grievance or formal escalation.

3. PF claim shows settled but money not credited—what does it mean?

“Settled” means payment is authorized, not credited. If the amount is not received within 3 working days, it usually points to bank rejection, IFSC error, or payment file failure.

4. How can I check the exact reason for PF claim delay online?

Check claim status using UAN login, review the remarks column, verify KYC status, and cross-check passbook entries. Blank remarks with no movement usually signal administrative delay.

5. When should I file a grievance for PF claim delay?

You should file a grievance if the claim exceeds 10–15 working days, remains under process without remarks, or is settled but not credited. Grievances trigger internal accountability.

6. Can RTI help in resolving delayed or stuck PF claims?

Yes. RTI is effective when grievances fail. It helps obtain officer details, file movement records, delay reasons, and action taken—often leading to faster resolution.

7. Is it advisable to file a new PF claim if the old one is delayed?

No. Filing a new claim can create duplication and further delay. Always resolve or escalate the existing claim through grievance or RTI before taking any new step.