Table of Content

1. Why Is My PF Withdrawal Showing ‘Under Process’ for a Long Time and What Should I Do First?

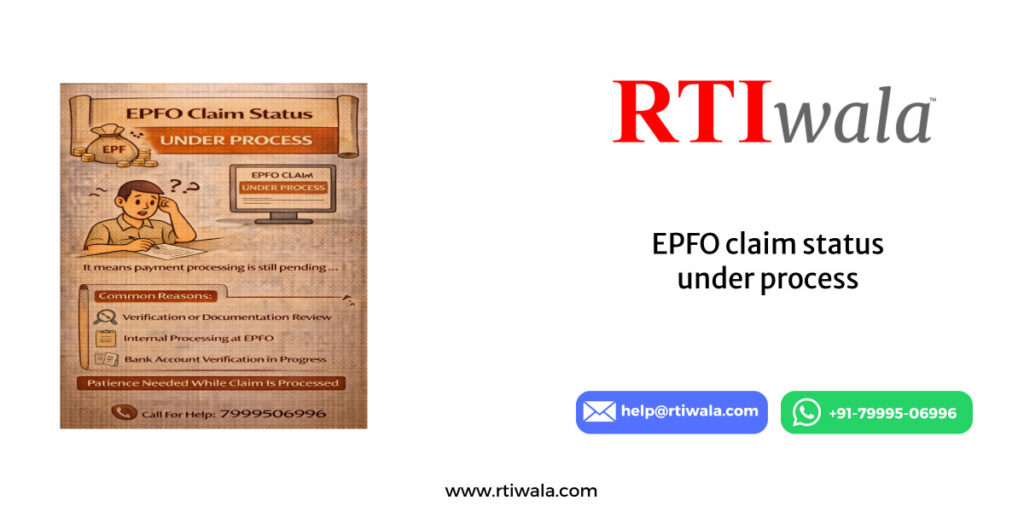

When your PF withdrawal status keeps showing “Under Process” for many days, it usually means your claim is stuck at verification or approval level. Most delays happen due to incomplete KYC, employer approval pending, or internal backlog at EPFO. The system does not automatically reject such claims, so they remain in processing for a long time.

In many cases, employees assume EPFO is delaying the payment. However, the claim often waits for employer digital verification or bank validation. Even a small mismatch in name, Aadhaar, or bank details can silently hold your settlement without notification.

Before panicking or filing complaints, first verify these basics:

- Aadhaar, PAN, and bank account must be linked and verified

- Bank account should be active and same as UAN records

- Employer approval should be completed

- Exit date should be updated by employer

- KYC status must show “Verified” in the portal

If any of these are incomplete, your claim will not move forward. Correcting these issues immediately solves most “Under Process” cases without escalation.

The first action should always be logging into the EPFO portal and checking your KYC and claim status carefully. Small corrections at this stage can save weeks of delay.

PF claim stuck or delayed? RTIwala helps you escalate fast and get answers today.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

2. How Many Days Does PF Settlement Take and When Should I Consider It Delayed?

Understanding the official timeline helps you decide whether your claim is actually delayed or still within normal processing time. Many people worry too early, even though EPFO is still working within its standard period.

Generally, PF settlement follows this timeline:

- Online claims: 7 to 10 working days

- Bank credit after approval: 2 to 3 days

- Total expected time: 10 to 15 days

If your claim crosses 15 working days without approval or payment, it should be treated as delayed. Beyond 20 to 30 days, it clearly indicates a problem requiring intervention.

Delays commonly increase during:

- Month-end bulk claims

- Financial year closing (March–April)

- System upgrades or technical issues

- Employer non-cooperation

Checking the exact claim stage is important. The portal shows statuses such as “Under Process”, “Approved”, “Settled”, or “Rejected”. If it is stuck at “Under Process” for more than 15–20 days, action is necessary.

Knowing this timeline prevents unnecessary stress and helps you take steps at the right time instead of waiting endlessly.

3. Step-by-Step Actions to Speed Up a Stuck PF Claim and Get It Settled Faster

If your PF claim is stuck beyond the normal period, taking structured action is better than waiting. Most delays are resolved quickly when you follow the right sequence instead of randomly raising complaints.

Follow these steps in order:

Step 1: Verify KYC again

Login to your EPFO member portal and confirm Aadhaar, PAN, and bank account are verified. If any detail shows “Pending”, update immediately and re-submit. Claims often resume automatically after correction.

Step 2: Check employer approval

Contact your HR or employer and ask whether digital approval is completed. Many claims remain pending simply because the employer has not verified the request in their portal.

Step 3: Track claim status daily

Use “Track Claim Status” to see movement. If it changes from “Under Process” to “Approved”, payment usually comes within 2–3 days. Monitoring helps you act quickly.

Step 4: Raise EPFO grievance

If no progress after 15–20 days, file a grievance through the EPFO grievance system. Provide your UAN, claim ID, and issue details clearly. This creates official pressure and speeds up review.

Step 5: Keep documents ready

Maintain screenshots, claim receipt, and KYC proofs. These are helpful if you need escalation or formal complaint. Having records avoids repeated back-and-forth.

Taking these steps systematically reduces delays significantly. Most users get their settlement within a few days after employer follow-up or grievance submission.

Ignoring the issue and simply waiting often increases the processing time. Proactive follow-up is the fastest way to receive your PF money.

4. Common Reasons for PF Settlement Time Delay (KYC Issues, Employer Approval, EPFO Errors Explained)

When a PF claim stays “Under Process” for too long, there is always a specific operational reason behind it. EPFO does not randomly hold payments. Most delays occur due to verification gaps, employer dependency, or technical mismatches in records.

The most common cause is incomplete or incorrect KYC. If your Aadhaar is not seeded properly, PAN is unverified, or bank details are mismatched, the system pauses the claim automatically. Even a small spelling difference between Aadhaar and UAN can block settlement silently.

Employer approval is another major bottleneck. Every online PF withdrawal requires digital verification from the employer. If HR delays approval or ignores the request, your claim does not move forward even though the portal shows “Under Process”.

Other frequent delay reasons include:

- Exit date not updated by employer

- Multiple UANs linked to the same member

- Bank account inactive or incorrect IFSC

- Signature mismatch in offline claims

- Heavy workload at EPFO regional office

- Technical server or system issues

Sometimes EPFO may seek internal clarification or cross-check contribution history. During this stage, the claim remains pending without clear communication. This is why regular tracking is important.

Understanding these real causes helps you fix the exact problem instead of waiting blindly. Most settlement delays are solved once the root issue is corrected.

5. How to Check PF Claim Status Online and Track Every Stage Correctly

Tracking your PF claim properly gives you clarity about where the process is stuck. Many people only check once and assume nothing is happening. Regular monitoring helps you take timely action.

You can check your claim status online through the EPFO member portal. Log in using your UAN and password, then open the “Track Claim Status” section. It shows the real-time stage of your withdrawal request.

You will usually see one of these statuses:

- Under Process – verification or approval pending

- Approved – claim accepted, payment initiated

- Settled – money transferred to bank

- Rejected – issue detected, correction required

If the status changes to “Approved”, payment typically arrives within two to three working days. If it stays “Under Process” for more than 15–20 days, it indicates delay and requires follow-up.

It is also helpful to:

- Check bank SMS alerts daily

- Verify passbook entries

- Take screenshots of status updates

- Note the claim submission date

Keeping records avoids confusion and strengthens your case if you raise a grievance or complaint. Proper tracking ensures you stay informed instead of depending only on assumptions.

Consistent monitoring is the simplest way to reduce uncertainty and speed up action when required.

PF claim stuck or delayed? RTIwala helps you escalate fast and get answers today.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

6. How to File Complaint or RTI if EPFO Does Not Process Your PF on Time

If your PF claim remains stuck even after correcting KYC and following up with the employer, formal escalation becomes necessary. EPFO provides official channels to resolve delayed settlements quickly.

The first step should always be filing an online grievance. Visit the EPFO grievance portal and submit details such as UAN, claim ID, and delay description. This complaint goes directly to the concerned regional office for review.

In most cases, grievance filing leads to faster action because:

- Your case gets registered officially

- Officers are assigned responsibility

- Timeline for response is fixed

- Tracking number is generated

If the grievance does not bring a clear response or settlement, you can escalate further using the Right to Information route. Filing an RTI application helps you demand accountability and exact processing details from EPFO.

Through RTI, you can ask for:

- Current status of your PF claim file

- Name and designation of responsible officer

- Reasons for delay beyond official timeline

- Expected settlement date

- Certified copies of file movement records

When departments know they must provide written explanations, cases are usually resolved faster. RTI works as a legal pressure tool to ensure transparency and timely action.

Taking structured escalation steps protects your rights and prevents unnecessary waiting. If internal follow-ups fail, formal complaint and RTI are the most effective solutions to get your PF released.

1. Why is my PF withdrawal still showing “Under Process” for many days?

Your claim usually remains “Under Process” due to pending employer approval, incomplete KYC, or bank detail mismatch. EPFO verification stops automatically if any record is incorrect. Check Aadhaar, PAN, bank details, and exit date immediately.

2. How many days does EPFO take to settle a PF withdrawal claim?

Online PF claims are normally settled within 7–10 working days. Including bank credit time, it may take 10–15 days. If it exceeds 15–20 days, it should be treated as delayed.

3. When should I worry about PF settlement delay?

You should take action if your claim shows “Under Process” for more than 15 working days or if there is no update for 20–30 days. This usually means employer approval or document verification is stuck.

4. Can employer delay my PF withdrawal approval?

Yes. Employer digital verification is mandatory for most claims. If HR does not approve your request on time, EPFO cannot process payment. Contact your employer directly for faster approval.

5. How can I speed up my stuck PF claim?

You can speed up settlement by:

- Verifying KYC details

- Confirming employer approval

- Tracking status daily

- Raising an EPFO grievance

- Keeping documents ready

These steps resolve most delays quickly.

6. How do I check my PF claim status online?

Login to the EPFO member portal using UAN and password. Go to “Track Claim Status” to see stages like Under Process, Approved, Settled, or Rejected. This shows real-time progress of your claim.

7. What happens if my PF claim is rejected?

If rejected, EPFO provides the reason in the portal. Usually it is due to KYC mismatch, incorrect bank details, or form errors. Correct the issue and submit a fresh claim.

8. How can I complain if EPFO is not processing my PF on time?

You can file an official grievance through the EPFO grievance portal. Provide your UAN and claim ID. Most complaints are resolved within a few days because officers must respond officially.