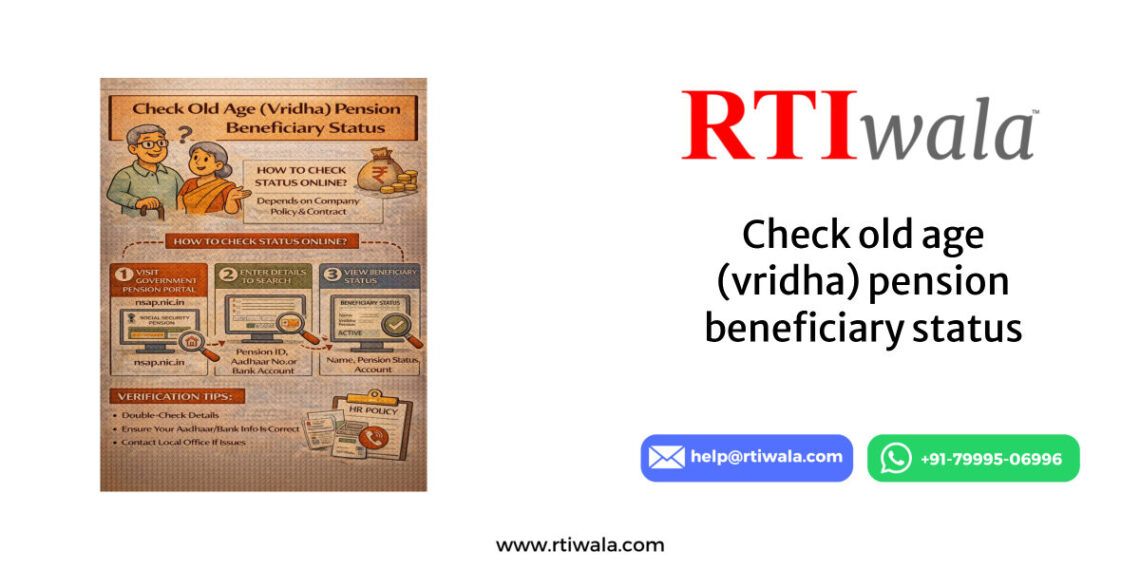

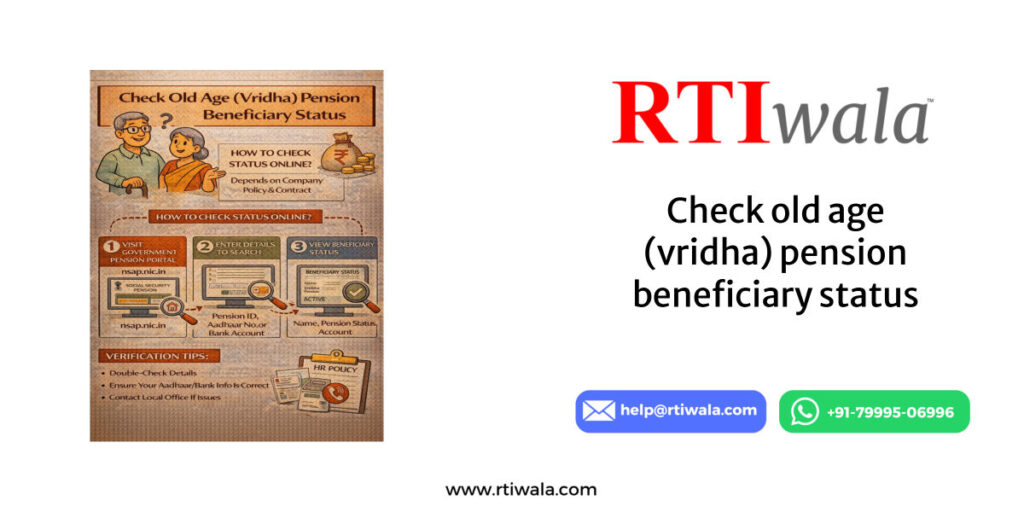

How to Check Old Age (Vridha) Pension Beneficiary Status Online

Old Age (Vridha) Pension is a critical monthly support for senior citizens, but many beneficiaries struggle to track whether their pension is approved, credited, or stuck.

Most users search this because money has not come, or no SMS/update is received, even after approval.

The government provides online systems to check this status, but the process varies by state and portal.

To check Vridha Pension beneficiary status online, you generally need basic identification details, not agents or middlemen.

The process is free, official, and accessible through state or central pension portals.

Checking status regularly helps detect delays early and prevents silent stoppage of pension.

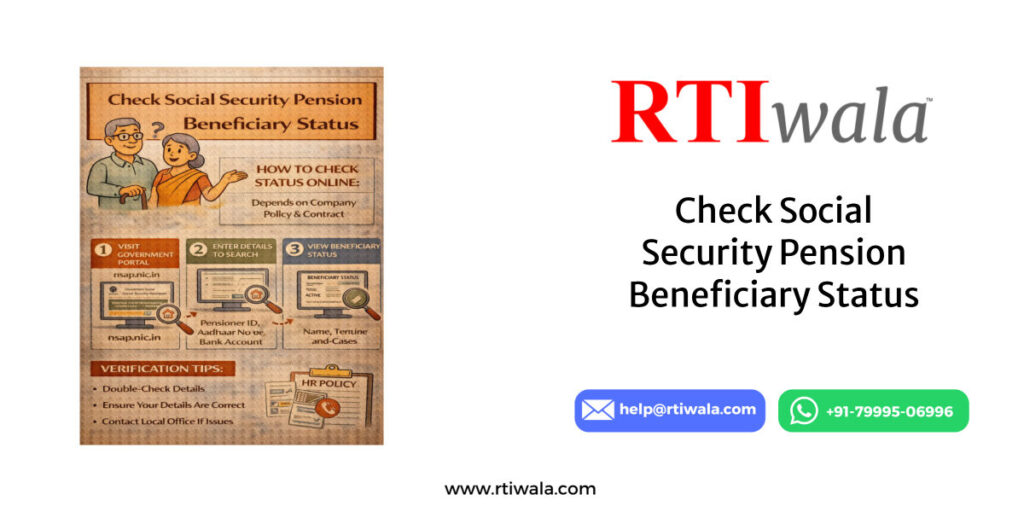

Common details required to check pension status online

Before starting, keep these details ready to avoid repeated errors:

- Aadhaar number (linked with pension)

- Pension ID / Beneficiary ID (if available)

- Registered mobile number

- District / Block / Panchayat details (for rural schemes)

If even one detail does not match government records, the portal may show “No Record Found”, which often confuses beneficiaries.

Step-by-step method to check Old Age Pension status

Most state portals follow a similar flow, even if names differ:

- Visit the official pension or social security portal of your state

- Select Old Age / Vridha Pension from scheme list

- Enter Aadhaar or Beneficiary ID

- Submit and view current status

The status page usually shows approval stage, payment history, last credited month, and bank linkage.

If the screen is blank or frozen, it often indicates backend verification issues, not user error.

Types of pension status you may see online

Understanding the status message is crucial, as each one indicates a different problem:

- Approved but Payment Pending – Fund not released or bank issue

- Under Verification – Aadhaar, income, or age verification pending

- Rejected – Document mismatch or eligibility issue

- Stopped – Silent stoppage due to KYC or audit flags

Many beneficiaries assume “approved” means money will come automatically, which is not always true.

Why checking online status is important

Regular status checks help senior citizens and families detect issues early instead of waiting months.

Delays often happen without any SMS, letter, or notice from authorities.

Online status is the only visible proof of what the government system currently shows about your pension.

Old age pension approved but not credited or stopped? RTIwala identifies the exact cause using RTI and resolves it fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Official Government Portals for Vridha Pension Status Check (State-Wise)

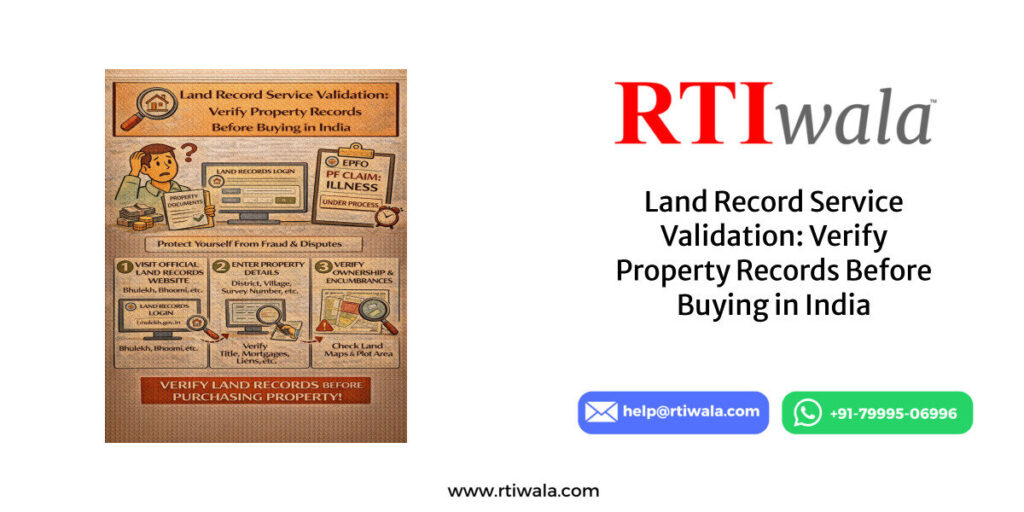

Old Age Pension is implemented under central and state schemes, so there is no single portal for all states.

Each state operates its own pension tracking system linked to district-level welfare departments.

At the central level, pension schemes operate under the National Social Assistance Programme framework.

Most users fail because they search the wrong portal or use outdated links shared on WhatsApp.

Using only official government portals ensures accurate and updated pension status.

Central-level pension status portals

These portals cover beneficiaries registered under national schemes:

- NSAP beneficiary portals for central pension schemes

- Public dashboards showing beneficiary and payment data

- State-linked redirection based on location

These portals usually show scheme-level data, not detailed bank transaction failures.

State-wise pension portals (general structure)

Each state has its own dedicated system, but features are largely similar:

- Beneficiary search using Aadhaar or Pension ID

- District, block, and village-wise filters

- Payment history with month-wise credit details

- Status remarks added by welfare department

If your pension is state-sponsored, checking the central portal alone will not show payment details.

Common mistakes people make while using portals

These errors lead to wrong assumptions that pension is stopped or deleted:

- Using old links not updated after portal migration

- Entering Aadhaar not linked with pension database

- Checking widow or disability pension instead of old age pension

- Assuming bank issues are not part of pension status

Government portals reflect backend data, not what local officers verbally promise.

What to do if portal shows no data or error

If the portal does not load or shows blank status:

- Retry during non-peak hours (morning or late night)

- Use desktop browser instead of mobile

- Cross-check spelling of name and district

- Verify Aadhaar linkage with pension office

Repeated “no data found” usually means record-level discrepancy, not internet error.

Old age pension approved but not credited or stopped? RTIwala identifies the exact cause using RTI and resolves it fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

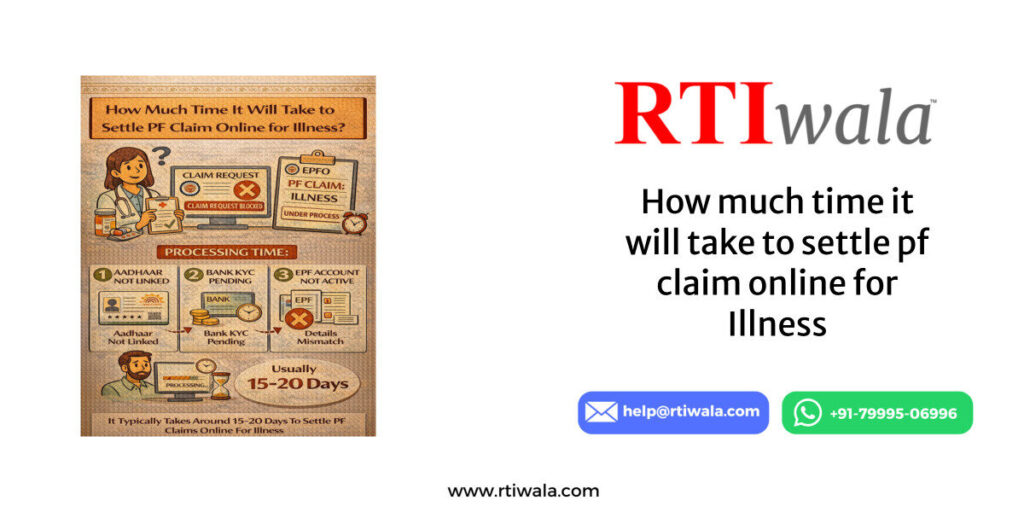

Why Old Age Pension Is Not Credited Even After Approval

Many beneficiaries see their Old Age (Vridha) Pension status as “Approved”, yet the pension amount never reaches the bank account.

This is one of the most common and frustrating issues faced by senior citizens across states.

Approval only confirms eligibility — it does not guarantee payment unless all backend conditions are fulfilled.

Most delays happen after approval, during fund release, verification, or bank processing stages.

Unfortunately, beneficiaries are rarely informed about these backend failures.

Bank account–related reasons for non-credit

Even a small mismatch can block pension credit silently:

- Bank account inactive or dormant

- Aadhaar not seeded correctly with bank account

- IFSC code changed after bank branch merger

- Account converted from savings to Jan Dhan or vice versa

In many cases, pension money is returned by the bank, but the beneficiary is never told.

Aadhaar and KYC verification issues

Approval may happen before full KYC verification is completed:

- Aadhaar biometric mismatch during re-verification

- Name or date of birth mismatch between Aadhaar and pension record

- PAN or income-linked verification flags

- Re-KYC pending after government audit

Once flagged, the system pauses payment without issuing notices.

Fund release and treasury-level delays

Sometimes the problem is not with the beneficiary at all:

- State treasury has not released monthly pension funds

- District-level sanction pending despite approval

- Financial year-end freezes delaying payments

- Scheme-wise fund exhaustion for that quarter

In such cases, thousands of approved beneficiaries remain unpaid, even though records are correct.

Backend status mismatch between departments

Different departments maintain different records:

- Welfare department shows “Approved”

- Treasury shows “Payment Pending”

- Bank shows “No transaction received”

Because systems are not fully integrated, the beneficiary is left confused with no clear answer.

Silent stoppage without notice

Pension can stop without SMS, letter, or call due to:

- Age re-verification triggers

- Duplicate beneficiary suspicion

- Local officer marking “verification pending”

- Annual audit objections

Approval status may still show “Active” while payment is completely stopped.

Documents Required to Track Vridha Pension Payment Status

Tracking Old Age Pension status effectively requires specific documents, not just Aadhaar.

Without proper documents, officials often refuse to give clear answers or delay resolution.

Keeping these documents ready saves months of follow-ups.

Primary documents required for status tracking

These are mandatory for both online and offline verification:

- Aadhaar Card (linked with pension)

- Pension Sanction Letter or Approval Slip

- Pension / Beneficiary ID number

- Bank Passbook (first page + recent entries)

Without the Beneficiary ID, many portals cannot fetch accurate data.

Bank-related documents needed

If pension is approved but not credited, bank documents become critical:

- Updated bank passbook with IFSC code

- Aadhaar–bank linkage confirmation slip

- Bank account KYC completion proof

- Statement showing last credited pension (if any)

These documents help identify whether the issue is bank-side or department-side.

Documents required for department verification

Local offices often ask for these during complaint or enquiry:

- Age proof (Birth Certificate / School Certificate)

- Income certificate (updated or renewed)

- Residence proof (ration card / voter ID)

- Life certificate (for continued eligibility)

Missing or expired certificates can stop pension without warning.

Online portal access documents

For accurate online tracking, keep:

- Registered mobile number (OTP access)

- District, block, and Panchayat details

- Application reference number (if available)

Incorrect district or block selection often results in “No Record Found” errors.

Old age pension approved but not credited or stopped? RTIwala identifies the exact cause using RTI and resolves it fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

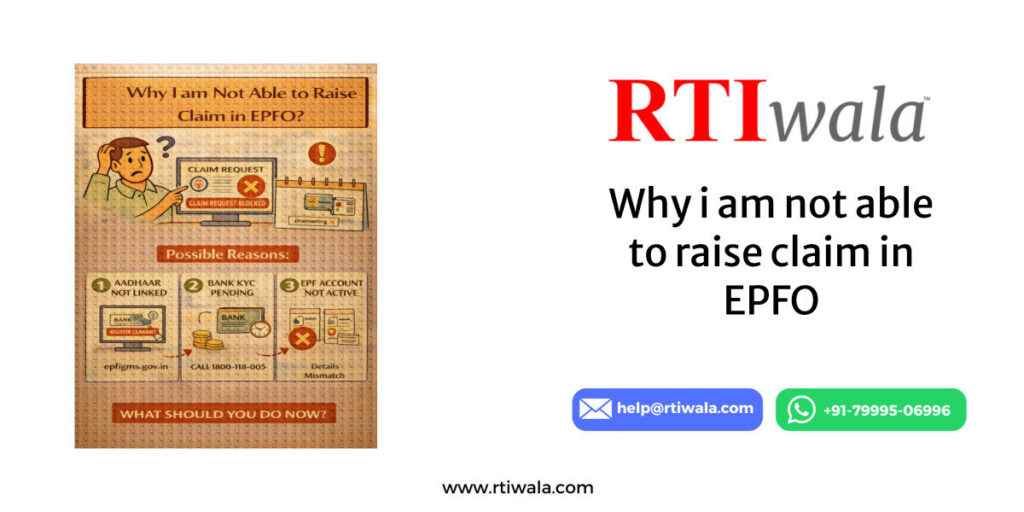

How to File a Complaint If Old Age Pension Status Shows Pending or Rejected

When Old Age (Vridha) Pension status shows Pending or Rejected, it does not mean the pension is permanently cancelled.

In most cases, the issue is procedural — missing documents, verification delays, or data mismatch.

Filing a complaint correctly is critical, because verbal follow-ups do not change system status.

Complaints must be filed through official channels only, otherwise they are not recorded in government systems.

Each state has a defined grievance mechanism linked to social welfare departments.

Where to file an official pension complaint

Depending on the state, complaints can be filed through:

- State Social Welfare or Pension Department portal

- District Collector or Social Welfare Officer office

- Online grievance portals (state-specific)

- Block or Panchayat welfare office (rural areas)

Always prefer written or online complaints over oral requests.

Information required while filing a complaint

A complaint without proper details is usually closed without action:

- Beneficiary name as per pension record

- Pension / Beneficiary ID number

- Aadhaar number (linked with pension)

- Current status shown on portal (Pending / Rejected)

- Bank account details for payment-related issues

Attach screenshots or printouts of online status wherever possible.

Common reasons complaints get ignored

Many complaints fail because of avoidable mistakes:

- Complaint filed without Beneficiary ID

- Wrong department selected

- No supporting documents attached

- Vague complaint text without clear issue

Officials act only when the issue is clearly defined and document-supported.

What to do if complaint shows “Under Process” for months

If your complaint remains unresolved:

- Re-submit with updated documents

- Escalate to district-level authority

- Take written acknowledgment if offline

- Track complaint number regularly

If no response is received within reasonable time, the issue is no longer administrative — it becomes a transparency failure.

How RTI Helps to Know Exact Reason for Old Age Pension Delay or Stoppage

When complaints fail and officials give unclear answers, RTI becomes the most effective solution.

RTI forces the department to disclose written, record-based reasons for delay, rejection, or stoppage.

Unlike complaints, RTI responses are legally binding and time-bound.

RTI is filed under the Right to Information Act and applies to all pension-related authorities.

This is the only method to uncover what is actually written in government files.

What RTI can reveal in pension delay cases

An RTI can extract information that officials often avoid sharing:

- Exact reason recorded for non-payment

- Date of last verification and officer name

- Whether funds were released or returned by bank

- File notings showing approval or objection

- Whether pension was stopped and on whose instruction

This information cannot be denied once asked properly.

Authorities against whom RTI can be filed

RTI can be filed with:

- District Social Welfare Office

- State Pension or Social Security Department

- Treasury Department (for fund release issues)

- Bank (for returned or failed transactions)

RTI identifies which authority is responsible, ending the blame game.

Why RTI works when complaints fail

RTI works because:

- Officials must reply within 30 days

- False or incomplete replies invite penalties

- Written records override verbal excuses

- RTI responses can be used for appeal or legal action

Once RTI is filed, files start moving faster because accountability increases.

Outcomes beneficiaries usually get through RTI

In real cases, RTI has helped beneficiaries:

- Restart stopped pensions

- Release pending arrears

- Correct Aadhaar or bank mapping issues

- Identify negligent officers

- Escalate matters to higher authorities

RTI converts uncertainty into clear, actionable facts.

Why RTI is essential for senior citizens

Senior citizens should not be forced to run from office to office.

RTI creates a paper trail that families can follow up on without harassment.

It is the most respectful and lawful way to demand pension transparency.

Old age pension approved but not credited or stopped? RTIwala identifies the exact cause using RTI and resolves it fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Frequently Asked Questions (FAQs)

1. How can I check Old Age (Vridha) Pension beneficiary status online?

You can check Old Age Pension status online using your Aadhaar number or Pension ID on the official state pension or social welfare department portal linked to your district.

2. Why is my old age pension approved but not credited to my bank account?

This usually happens due to Aadhaar–bank linkage issues, inactive bank accounts, fund release delays, or backend verification problems even after pension approval.

3. What does “Approved but Payment Pending” mean in pension status?

It means you are eligible, but the pension amount has not been released or credited due to treasury delays, bank rejection, or incomplete verification at the department level.

4. Which documents are required to track old age pension payment status?

You need Aadhaar card, Pension/Beneficiary ID, bank passbook, approval letter, and registered mobile number to accurately track pension status online or offline.

5. What should I do if my old age pension status shows rejected?

You should file an official complaint with the social welfare department using your Beneficiary ID and documents, and check the rejection reason mentioned on the pension portal.

6. How can RTI help in old age pension delay or stoppage cases?

RTI can reveal the exact written reason for pension delay, rejection, or stoppage, including file notings, officer remarks, fund release status, and verification details.

7. Where can I file a complaint if my old age pension is pending for months?

You can file a complaint on the state pension portal, social welfare department grievance system, or escalate through RTI if there is no response within a reasonable time.