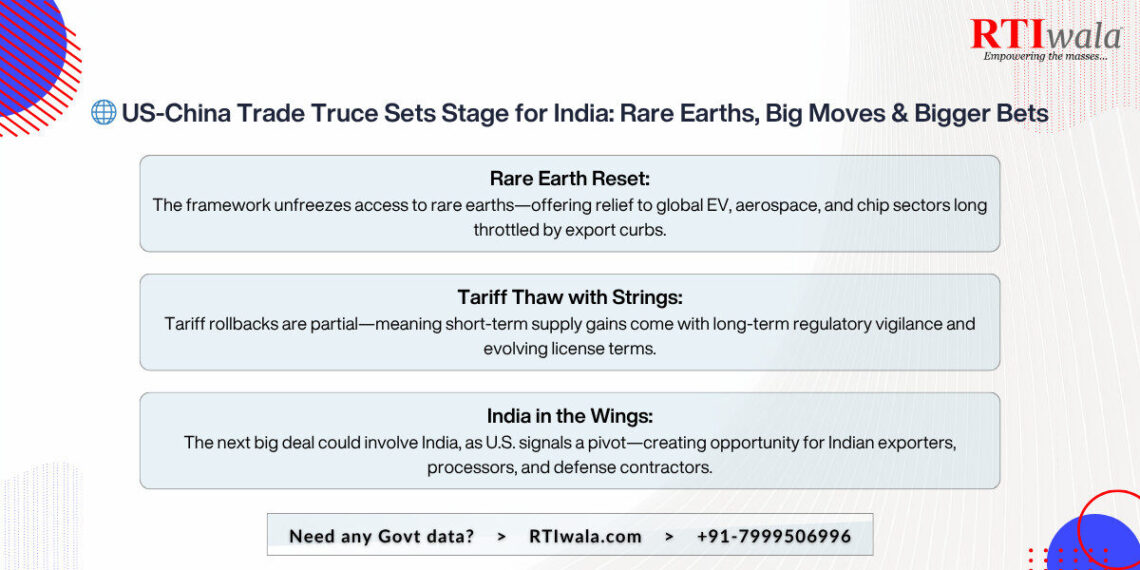

The United States and China have officially finalized a trade framework agreement to implement the Geneva and London accords reached earlier in 2025. While details remain emerging, stakeholders across industries must now prepare for strategic shifts in supply chains, trade policy, and global sourcing.

📊 Key Highlights:

1️⃣China will accelerate export approvals for rare earth minerals and magnets, essential for EVs, semiconductors, aerospace, and defense. In return, the U.S. will lift several previously imposed restrictive measures and tariffs.

2️⃣Total U.S. tariffs on Chinese imports now stand at ~55% (10% baseline + 20% fentanyl-related + 25% pre-existing tariffs), while China will maintain 10% tariffs on U.S. goods.

3️⃣Implementation mechanisms include six-month temporary licenses for mineral shipments, signaling a cautious but actionable step forward.

🔍 What It Means for Stakeholders:

1️⃣Supply Chain Security: India-based electronics, automotive, and defense irms reliant on rare earths can mitigate risk and realign sourcing strategies.

2️⃣Investment Signals: EV and semiconductor sectors may benefit from stabilized raw material access; global inventory clocks may need recalibration.

3️⃣Policy Uncertainty Looms: Though exporting resumes, significant existing tariffs remain—importers must track rapidly evolving customs and compliance norms.

4️⃣Geo‑Political Shifts: India’s emerging role as the next potential U.S. trade partner could reshape demand and investment projections across sectors.

🛠️ How RTIwala Empowers Strategic Decisions:

1️⃣Import Policy & Tariff Analysis Access government filings on export licenses, customsduty structures, and ongoing tariff deliberations.

2️⃣Supply Chain Mapping Identify industries and OEMs reliant on rare earth imports, with precise shipment origin tracing.

3️⃣Risk & Compliance Monitoring Track updates on export restrictions, mineral export consents, and allied regulatory shifts.

4️⃣Strategic Planning for India-US Pact Monitor ongoing India–US trade talks, market access barriers, and sector-specific negotiation documentation.

🏭The Global Trade & Supply Chain Industry Leaders:

A.P. Moller – Maersk, FedEx, Tata Motors, Boeing, and Foxconn continue to shape the global movement of goods, high-tech manufacturing, and cross-border commerce—adapting to evolving geopolitical frameworks.

🚀And, these are the remarkable startups of Global Trade & Supply Chain industry :

Ninjacart, ElasticRun, BlackBuck (Zinka Logistics Solutions Ltd), and Moglix—Indian disruptors redefining B2B logistics, inventory tech, and last-mile distribution in a multipolar global economy.

🔗 Stay Ahead with RTIwala

🌐 RTIwala.com now!

📞 +91‑7999‑50‑6996 for expert help!

Transform uncertainty into opportunity using actionable public data.

RTIwala, Legaltech, AskRTIwala, USChinaTrade, RareEarths, IndiaTrade, SupplyChainResilience