How Many Days Does PF Withdrawal Take After Claim Submission

After submitting a PF withdrawal claim, most users want one clear answer: “How many days will it take?”

Under official rules of Employees’ Provident Fund Organisation, PF withdrawal is expected to be processed within 7 to 20 working days from the date of successful submission.

In real-life cases, however, the timeline varies based on verification and backend checks. Many applicants experience delays beyond the promised period without receiving any explanation.

Standard PF Withdrawal Timeline (Ideal Scenario)

If all records are correct and verified, the expected time frame is:

- Claim submitted successfully on the EPFO portal

- Employer verification already completed or not required

- Aadhaar, PAN, and bank details seeded correctly

- No discrepancy in service history

When PF Withdrawal Takes Longer Than Expected

Delays commonly happen when the system flags even minor issues. In such situations, processing can stretch to 20–30 working days or more, without proactive updates to the applicant.

Common backend factors affecting time:

- Pending KYC approval

- Employer digital verification delays

- Data mismatch across records

- Manual intervention by EPFO office

Important Reality Check for Applicants

Even though rules mention a maximum time limit, there is no automatic compensation or alert when PF processing crosses timelines.

This leaves applicants confused, repeatedly checking claim status without knowing the real reason for delay.

Key takeaway:

If your PF withdrawal crosses 15–20 working days, it is no longer “normal processing time” — it indicates a system or verification issue that needs to be identified.

PF withdrawal delayed or amount not credited? RTIwala uses RTI to trace EPFO delays and get answers fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

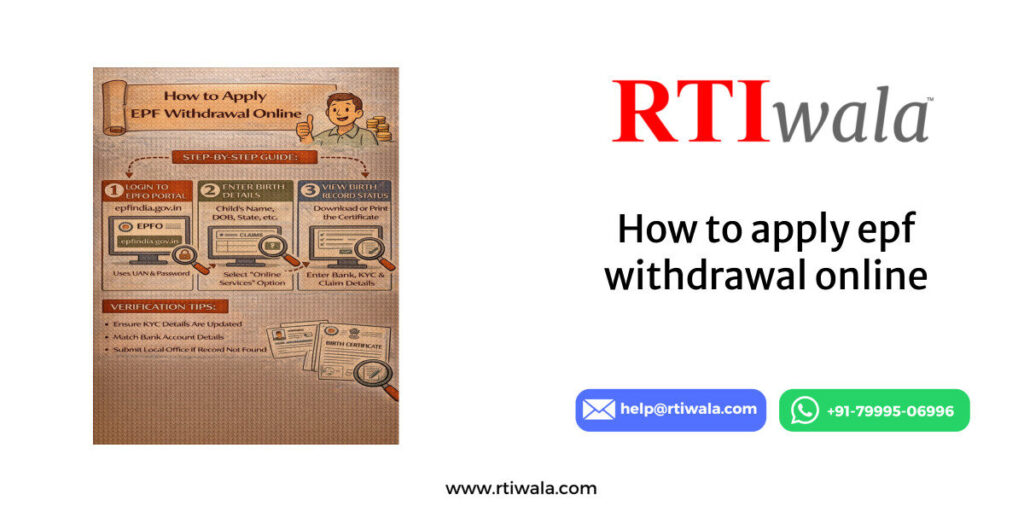

PF Withdrawal Time for Online vs Offline Claims

The mode of PF withdrawal — online or offline — plays a major role in how fast (or slow) your money reaches your bank account. Understanding this difference helps set the right expectations and avoid unnecessary stress.

PF Withdrawal Time for Online Claims

Online PF claims filed through the EPFO portal are designed to be faster because they reduce human dependency.

Typical timeline for online claims:

- Submission to processing: 2–3 working days

- Verification & approval: 5–10 working days

- Amount credit: within 7–15 working days (ideal cases)

Online claims generally move faster only when:

- Aadhaar-based OTP verification is successful

- Employer approval is already completed

- No corrections are required at EPFO office level

However, even online claims can get stuck if the backend system detects:

- Employer exit date mismatch

- KYC approval still pending

- Multiple UAN/member IDs not merged

- Bank IFSC or account validation failure

PF Withdrawal Time for Offline Claims

Offline PF withdrawal involves physical submission of forms through the employer or directly at the EPFO office, making the process slower and less transparent.

Typical timeline for offline claims:

- Submission acknowledgment: 5–10 working days

- Manual verification: 15–30 working days

- Total processing time: 30–45 days or longer

Offline claims are more prone to:

- File movement delays between departments

- Missing document objections

- Lack of online status clarity

- Dependency on office workload and staff availability

Online vs Offline PF Withdrawal – Practical Comparison

From a user-experience perspective:

- Online claims are faster but highly sensitive to data accuracy

- Offline claims are slower and risk getting stuck without clear updates

- Neither method guarantees timelines if backend issues exist

This is why many applicants see their PF claim marked “under process” for weeks, regardless of filing mode.

PF withdrawal delayed or amount not credited? RTIwala uses RTI to trace EPFO delays and get answers fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

PF Claim Status Stages and What Each Status Means

When a PF claim is submitted, applicants usually see vague status messages on the portal. These short labels hide important backend actions. Understanding each stage helps you identify where exactly the delay is happening inside Employees’ Provident Fund Organisation.

Claim Submitted

This status means:

- Your PF claim form is successfully filed

- Application is registered in the EPFO system

- No processing has started yet

At this stage:

- No verification is done

- No officer is assigned

- This stage usually lasts 1–3 working days

If it stays longer, it indicates system queue delay.

Claim Under Process

This is the most confusing and problematic stage for users.

“Under Process” means:

- EPFO has started backend verification

- KYC, service records, and employer data are being checked

- File may be moving between digital and manual scrutiny

This stage can last:

- 5–10 working days in normal cases

- 15–30+ days if discrepancies are found

Important point:

The portal does not show what issue is being checked, leaving applicants unaware of the real reason.

Claim Approved

Once approved:

- Verification is complete

- Payment order is generated

- Funds are queued for bank transfer

After approval:

- Amount is usually credited within 2–5 working days

- Delay here generally indicates bank-side processing or NPCI routing issues

Claim Settled

“Settled” does not always mean credited.

It means:

- EPFO has released the payment

- Transaction reference is generated

- Bank transfer is initiated

If money is not credited even after “settled”:

- Bank details mismatch

- Failed NEFT/RTGS transfer

- Amount returned to EPFO account

This is a critical stage where users often assume completion, while money is still missing.

PF withdrawal delayed or amount not credited? RTIwala uses RTI to trace EPFO delays and get answers fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Reasons Why PF Withdrawal Is Getting Delayed

PF withdrawal delays almost never happen randomly. In most cases, specific record-level issues block the claim silently. Below are the most common, real-world reasons observed in delayed PF cases.

KYC Not Properly Approved

Even if Aadhaar or PAN is uploaded, delays occur when:

- Employer has not digitally approved KYC

- Aadhaar name doesn’t match PF records

- PAN validation fails with Income Tax database

Without full KYC approval:

- Claim moves slowly

- Manual checks are triggered

- Processing timeline increases significantly

Employer Exit Date or Service Details Issue

This is one of the top hidden causes.

Delays occur when:

- Employer has not updated exit date

- Exit reason is missing or incorrect

- Service period overlaps with another employer

Until employer data is corrected:

- Claim remains “under process”

- No payment is released

Multiple UAN or Member ID Problems

Many employees unknowingly have:

- Multiple Member IDs

- Old UAN linked to previous jobs

- Unmerged PF accounts

This creates:

- Verification conflicts

- Contribution mismatch

- Manual scrutiny by EPFO office

Claims often pause until records are merged or clarified.

Bank Account or IFSC Mismatch

Small bank errors cause big delays, such as:

- Closed or inactive bank account

- Incorrect IFSC code

- Name mismatch between PF and bank records

In such cases:

- Payment fails silently

- Amount may be reversed

- Claim status doesn’t clearly show the failure

Internal EPFO Office Backlog

Sometimes, the delay is not personal but systemic.

This happens due to:

- High claim volume at specific EPFO offices

- Staff shortages or transfers

- Manual verification backlog

Applicants receive no alerts, even when files remain pending for weeks.

PF withdrawal delayed or amount not credited? RTIwala uses RTI to trace EPFO delays and get answers fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

How to Speed Up PF Withdrawal Process

If your PF claim is moving slowly, waiting passively rarely helps. The only way to speed it up is to remove the exact blocker that is holding the file inside Employees’ Provident Fund Organisation systems.

Step 1: Recheck KYC Approval Status

Speed depends heavily on KYC being fully verified.

Immediately confirm:

- Aadhaar status shows “Approved by Employer”

- PAN is verified and active

- Bank account is verified with correct IFSC

If any KYC shows “Pending”:

- Claim processing slows down automatically

- Manual verification is triggered

- Timeline extends without warning

Step 2: Verify Employer Exit Date and Reason

Many claims remain stuck because exit details are incomplete.

Check whether:

- Exit date is updated correctly

- Exit reason is mentioned

- Employment duration is accurate

If exit details are missing:

- Employer must update it digitally

- PF claim cannot move forward

- Claim stays “under process” indefinitely

Step 3: Track Claim Movement, Not Just Status

Don’t rely only on the status label.

Actively monitor:

- Date of last status update

- Number of days since “Under Process”

- Any change in remarks or history

If there is no movement for 10–15 working days, it is a clear signal of backend blockage.

Step 4: Use the EPFO Grievance Route Correctly

Raising a grievance works only if done precisely.

While submitting:

- Mention UAN and claim reference number

- Clearly state delay duration in days

- Ask for “specific reason for delay”

Vague grievances like “Please process my claim” rarely help.

Specific, timeline-based queries get faster attention.

Step 5: Avoid Multiple Claim Submissions

Many users unknowingly delay their claim further by:

- Submitting multiple claims

- Cancelling and reapplying repeatedly

This creates:

- Duplicate records

- System confusion

- Manual intervention requirement

One clean, corrected claim processes faster than multiple attempts.

PF withdrawal delayed or amount not credited? RTIwala uses RTI to trace EPFO delays and get answers fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

What to Do If PF Amount Is Not Credited on Time

A very common and stressful situation is when the PF claim shows “Settled”, but the money is not received in the bank account. This does not mean the process is complete.

Step 1: Note the Settlement Date Carefully

Once the status changes to “Settled”:

- EPFO has released the payment

- Bank transfer is initiated

- Credit should happen within 2–5 working days

If money is not credited after this period, action is required.

Step 2: Check Bank Account and IFSC Again

Most post-settlement failures happen due to banking issues.

Verify:

- Account is active and not dormant

- IFSC code is correct

- Name matches PF records

Even a minor mismatch can:

- Cause transaction failure

- Reverse the amount back to EPFO

- Leave no visible error message on the portal

Step 3: Look for Payment Failure or Reversal

If payment fails:

- Amount may be reversed to EPFO

- Claim status may still show “Settled”

- User receives no notification

This is a critical gap where applicants assume completion, while money is stuck in limbo.

Step 4: Raise a Transaction-Specific Grievance

When amount is not credited:

- Mention settlement date

- Mention non-credit beyond 5 working days

- Ask for UTR/transaction reference

This forces internal tracing of the payment instead of generic replies.

Step 5: Escalate If No Resolution Comes

If there is:

- No response to grievance

- No credit after escalation

- Repeated silence from EPFO

Then the issue is no longer “processing delay” — it becomes an accountability and record-tracking problem that needs formal intervention.

PF withdrawal delayed or amount not credited? RTIwala uses RTI to trace EPFO delays and get answers fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Frequently Asked Questions (FAQs)

1. How many days does PF withdrawal take after submitting a claim?

PF withdrawal usually takes 7–20 working days after claim submission. If processing exceeds this period, it often indicates verification, KYC, or employer-related issues within Employees’ Provident Fund Organisation systems.

2. Why is my PF claim showing “Under Process” for many days?

“Under Process” means backend verification is ongoing. Delays occur due to pending KYC approval, employer exit date issues, record mismatch, or EPFO office backlog, even though no specific reason is shown on the portal.

3. Is PF withdrawal faster for online claims compared to offline claims?

Yes. Online PF claims are generally faster and are processed within 7–15 working days if all records are correct. Offline claims involve manual handling and may take 30–45 days or longer.

4. What does PF claim status “Settled” mean?

“Settled” means EPFO has released the payment and initiated the bank transfer. However, it does not always mean the amount is credited. Bank verification or transfer failure can still delay the credit.

5. What should I do if my PF amount is not credited after settlement?

If the PF amount is not credited within 5 working days after settlement, you should check bank details, IFSC code, and account status, then raise a transaction-specific grievance requesting the payment reference number.

6. Can PF withdrawal be delayed due to employer issues?

Yes. PF withdrawal is commonly delayed when the employer has not updated the exit date, service details, or approved KYC. Until employer records are corrected, EPFO cannot complete the claim.

7. How can I speed up my PF withdrawal process?

To speed up PF withdrawal, ensure all KYC is approved, exit details are correct, bank information is accurate, and raise a clear, timeline-based grievance if the claim remains pending beyond normal processing time.