What Is the Retirement Age in Private Companies in India

For most employees working in private companies in India, there is no single fixed retirement age that applies universally. Unlike government jobs, private sector retirement depends largely on company policy, employment contracts, and internal HR rules. This often creates confusion for employees nearing their late 50s or early 60s.

In practice, the common retirement age in private companies ranges between 58 and 60 years. However, this is not a rule—it is only a widely followed practice. Many private organizations do not even mention a retirement age unless it is required for compliance or internal structuring.

Key points employees should clearly understand:

- Retirement age is not automatically fixed by law in private jobs

- It must be mentioned in the appointment letter, HR policy, or standing orders

- If no age is defined, employment may continue based on performance or company discretion

This lack of uniformity means two employees in different companies—or even in the same industry—can have completely different retirement outcomes.

How Companies Decide Retirement Age

Private companies usually decide retirement age based on:

- Nature of work (physical, technical, managerial)

- Industry standards (manufacturing, IT, finance, etc.)

- Long-term workforce planning

- Cost of senior employees vs productivity

For example:

- Manufacturing units often follow 58 years

- Corporate offices and MNCs often follow 60 years

- Startups may have no defined retirement age at all

Because of this flexibility, many employees wrongly assume they can work till 60, only to later discover that their contract says otherwise.

Why This Becomes a Problem for Employees

Problems usually arise when:

- The appointment letter is silent on retirement age

- HR policy is changed without proper communication

- Employees are verbally told one age but documents say another

This leads to situations where employees are suddenly informed:

- “Your services will end next month”

- “Company policy has changed”

- “We do not extend employment beyond 58”

Without written clarity, employees are often left confused, anxious, and financially unprepared.

Facing forced retirement or delayed PF/gratuity? RTIwala uncovers official reasons and fixes benefit issues fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Is There Any Legal Rule for Retirement Age in Private Sector Jobs

A crucial truth every private employee must know is this:

Indian labour laws do NOT prescribe a fixed retirement age for private sector jobs.

Unlike government employment, where retirement age is set by service rules, the private sector operates under contractual employment principles. This means the employment agreement overrides assumptions.

What the Law Actually Says

Indian labour laws allow private employers to:

- Fix a retirement age

- Change it (with conditions)

- Not define one at all

However, there are important legal boundaries:

- The retirement age must not be arbitrary

- It must be uniformly applied

- It must be clearly documented

If a company has certified standing orders or service rules, the retirement age mentioned there becomes legally binding.

Situations Where Retirement Age Becomes Legally Enforceable

A private company’s retirement age becomes enforceable if:

- Mentioned in appointment letter or contract

- Defined in HR or service rules

- Part of certified standing orders under labour law

- Accepted and followed consistently for all employees

In such cases, the employee cannot be forced to retire earlier or later unless the policy allows it.

When Companies Cannot Force Retirement

A company cannot legally force early retirement if:

- No retirement age is mentioned anywhere

- Others in similar roles are allowed to continue

- The exit is disguised as “policy change” without notice

- The decision is discriminatory or targeted

Such actions may qualify as:

- Unfair labour practice

- Illegal termination

- Violation of contractual terms

Why Employees Must Be Extra Careful

Most private employees realize the importance of retirement rules only when it’s too late—after HR issues a final notice. At that stage, documents matter more than conversations.

Employees should always:

- Recheck appointment letters

- Ask for written HR policies

- Preserve emails and service records

Because once retirement is enforced, reversing it becomes legally complex and time-sensitive.

Can Private Companies Change or Extend the Retirement Age

Yes, private companies can change or extend the retirement age, but only under specific legal and procedural conditions. This flexibility exists because private employment in India is contract-based, not rule-based like government jobs. However, this does not mean companies have unlimited power.

A company can revise retirement age only when:

- The change is backed by written policy

- Proper notice or communication is given

- The change is applied uniformly across employees

Any sudden or selective change can be challenged.

Facing forced retirement or delayed PF/gratuity? RTIwala uncovers official reasons and fixes benefit issues fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

When Changing Retirement Age Is Considered Valid

A retirement age change is generally considered valid if:

- It is updated in HR policy or service rules

- Employees are informed in advance

- Existing employees formally accept or acknowledge it

- It aligns with labour laws and standing orders

For example, increasing retirement age from 58 to 60 is usually allowed if it:

- Benefits employees

- Is applied across the organization

- Does not violate existing contracts

Such extensions are common during talent shortages or restructuring phases.

When Retirement Age Change Becomes Illegal

A company cannot legally change retirement age if:

- It contradicts the appointment letter

- It targets specific employees or departments

- It is used to push out senior employees

- No formal documentation exists

In these cases, the action may amount to:

- Forced exit

- Constructive dismissal

- Unfair labour practice

Verbal announcements or internal emails without policy backing do not hold legal value.

Extension After Retirement Age – Is It a Right?

Employees often assume extension after retirement is a right.

Legally, it is not.

Extensions depend on:

- Company discretion

- Business needs

- Performance requirements

Unless the policy explicitly allows extensions, companies are not obligated to grant them. Most extensions are offered on:

- Contractual basis

- Fixed-term roles

- Consultancy arrangements

Understanding this distinction prevents false expectations.

What Employees Should Do Before Accepting a Change

Before agreeing to a revised retirement age, employees should:

- Ask for updated written policy

- Check impact on PF, gratuity, and service continuity

- Ensure no reduction in benefits or status

- Preserve proof of acceptance or rejection

These steps protect employees from future disputes or benefit losses.

Retirement Age Difference Between Private and Government Jobs

The retirement age difference between private and government jobs is one of the biggest structural contrasts in Indian employment. Many employees shift sectors without fully understanding this gap, which later leads to confusion and financial stress.

Government Jobs – Fixed and Protected

In government employment:

- Retirement age is clearly defined by service rules

- Usually fixed at 60 years

- Cannot be changed arbitrarily

- Protected by constitutional and statutory safeguards

Once appointed, a government employee knows:

- Exact retirement date

- Pension eligibility

- Post-retirement benefits

This certainty provides long-term financial predictability.

Private Jobs – Flexible but Uncertain

In private sector jobs:

- Retirement age varies from company to company

- Commonly 58 or 60, but not guaranteed

- Subject to policy changes

- Dependent on contracts and HR rules

There is no universal retirement protection, which means:

- Employment can end earlier

- Extensions are discretionary

- Benefits depend on compliance, not entitlement

This flexibility benefits employers but increases risk for employees.

Key Differences at a Glance

Major differences employees should understand:

- Government retirement is rule-based

- Private retirement is contract-based

- Government exits are predictable

- Private exits can be sudden

- Legal remedies differ significantly

Employees transitioning from private to government—or vice versa—often underestimate these differences.

Why This Difference Matters Financially

The retirement age difference directly affects:

- PF accumulation

- Gratuity eligibility

- Long-term savings planning

- Health and insurance continuity

A two-year difference in retirement can mean:

- Loss of gratuity eligibility

- Lower PF corpus

- Sudden income stoppage

This is why understanding retirement rules before joining or nearing exit is critical.

Facing forced retirement or delayed PF/gratuity? RTIwala uncovers official reasons and fixes benefit issues fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

What Happens to PF, Gratuity, and Pension After Retirement

When an employee retires from a private company, the biggest concern is usually financial security. Understanding what happens to PF, gratuity, and pension is critical because delays or mistakes here can directly affect post-retirement life.

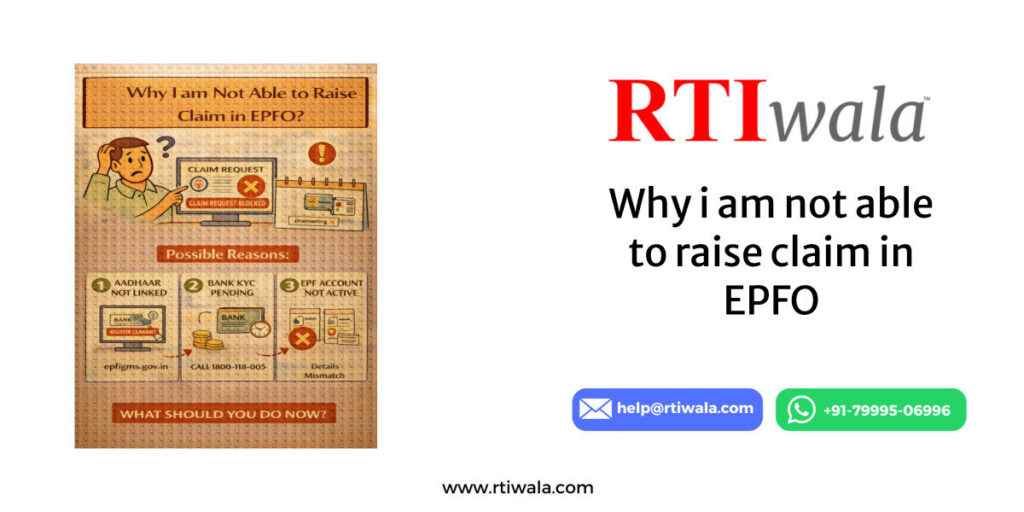

Provident Fund (PF) After Retirement

After retirement, an employee becomes fully eligible to withdraw the entire PF balance. This includes:

- Employee contribution

- Employer contribution

- Accumulated interest

PF withdrawal is governed by rules of Employees’ Provident Fund Organisation, not by the employer’s discretion.

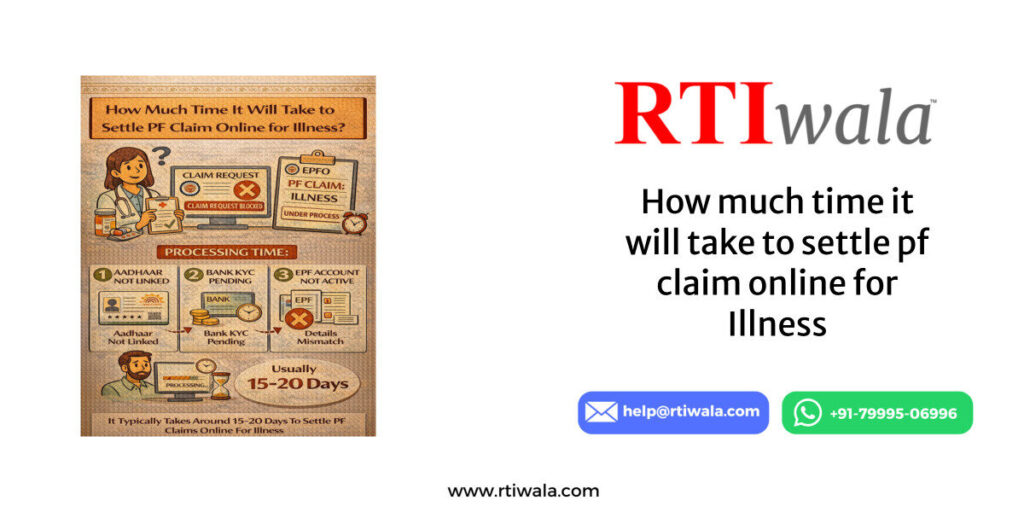

Important PF points after retirement:

- Full withdrawal allowed after retirement age or job exit

- No tax on PF if service exceeds 5 years

- Bank and KYC details must be accurate to avoid rejection

- Delay usually occurs due to employer verification issues

If PF is not settled even after exit, it is a procedural lapse, not a benefit denial.

Gratuity Eligibility and Payment

Gratuity becomes payable if:

- The employee has completed 5 or more continuous years of service

- Retirement, resignation, or termination has occurred

Key gratuity facts:

- Retirement age does not affect eligibility

- Employer must pay gratuity within 30 days

- Interest becomes payable on delayed payment

- Gratuity cannot be denied citing financial loss or performance issues

Even if an employee retires earlier than expected, gratuity remains a statutory right, not a favor.

Pension in Private Sector – The Reality

Most private employees assume they will receive pension, but in reality:

- Pension is applicable only under EPS (Employees’ Pension Scheme)

- Minimum 10 years of service is required

- Pension amount is modest and rule-based

After retirement:

- Employees can apply for monthly pension

- Or opt for withdrawal benefit if service is below threshold

- Delays often occur due to incomplete service records

Pension issues are common where companies fail to submit accurate PF/EPS data during employment.

Why Benefit Issues Happen After Retirement

Common reasons include:

- Incorrect joining or exit dates

- Employer not approving claims

- Mismatch in Aadhaar or bank details

- Missing contribution records

These issues are administrative, but they can cause months of financial stress if not addressed properly.

What to Do If a Company Forces Early Retirement or Exit

Forced early retirement in private jobs is becoming increasingly common, especially for senior employees. Many exits are framed as policy decisions or organizational restructuring, leaving employees confused about their rights.

What Counts as Forced Early Retirement

Early retirement may be considered forced if:

- Retirement age is suddenly enforced without notice

- Exit is pushed before the documented retirement age

- Only selected employees are affected

- Pressure is applied to resign instead of retiring

Such actions are often disguised but legally questionable.

Immediate Steps Employees Should Take

If forced exit occurs, employees should:

- Ask for written explanation

- Request policy or rule supporting the decision

- Preserve appointment letter, HR policies, emails

- Avoid signing exit documents under pressure

Documentation is the strongest protection at this stage.

When Forced Exit Becomes Illegal

A company may be acting illegally if:

- Retirement age is not defined anywhere

- Exit violates appointment letter terms

- Policy change is applied selectively

- Benefits are withheld to force acceptance

These cases may qualify as:

- Illegal termination

- Unfair labour practice

- Breach of contract

Legal remedies depend on proof, not assumptions.

Financial Protection During Forced Exit

Even in forced retirement:

- PF must be released

- Gratuity remains payable

- Salary dues cannot be withheld

- Experience and relieving letters cannot be denied arbitrarily

Employers cannot use benefit withholding as a pressure tactic.

Why Silence Is Risky for Employees

Many employees accept forced retirement silently due to:

- Fear of legal costs

- Lack of awareness

- Pressure to settle quickly

This often leads to permanent loss of benefits or delayed settlements. Acting late reduces available remedies.

Facing forced retirement or delayed PF/gratuity? RTIwala uncovers official reasons and fixes benefit issues fast—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Practical Advice Before Accepting Exit

Before accepting early retirement or exit:

- Verify legality of the decision

- Ensure benefits are calculated correctly

- Get everything in writing

- Seek clarification, not confrontation

A calm, document-based approach protects long-term interests.

Frequently Asked Questions (FAQs)

1. What is the standard retirement age in private companies in India?

There is no fixed retirement age for private sector jobs in India. Most companies follow 58 or 60 years, but the actual age depends on what is mentioned in the appointment letter, HR policy, or service rules.

2. Is retirement age legally mandatory in private sector employment?

No, Indian labour laws do not mandate a specific retirement age for private companies. Retirement age becomes legally enforceable only if it is clearly defined in employment contracts or certified company policies.

3. Can a private company force an employee to retire early?

A private company cannot force early retirement if the retirement age is not documented or if the action violates the appointment letter or company policy. Forced early exits may be treated as illegal termination.

4. Can a private company change or extend the retirement age later?

Yes, a private company can change or extend retirement age, but only through written policy changes, proper communication, and uniform application. Selective or sudden changes can be legally challenged.

5. What happens to PF and gratuity after retirement in a private job?

After retirement, employees are eligible to withdraw their full PF amount and receive gratuity if they have completed five years of service. Employers cannot delay or deny these statutory benefits.

6. Is pension guaranteed after retirement in private sector jobs?

No, pension is not guaranteed in private sector employment. Pension is available only under the Employees’ Pension Scheme (EPS) and depends on years of service and contribution history.

7. What should an employee do if retirement benefits are delayed or withheld?

Employees should first seek written clarification from the employer. If benefits remain unpaid, they can escalate the matter through formal complaints or information requests to the concerned authority.