In FY25, Indian banks have significantly increased their investments in mutual funds, marking a strategic shift in asset allocation. This move is driven by subdued credit demand and an abundance of liquidity in the financial system.

📊Key Highlights:

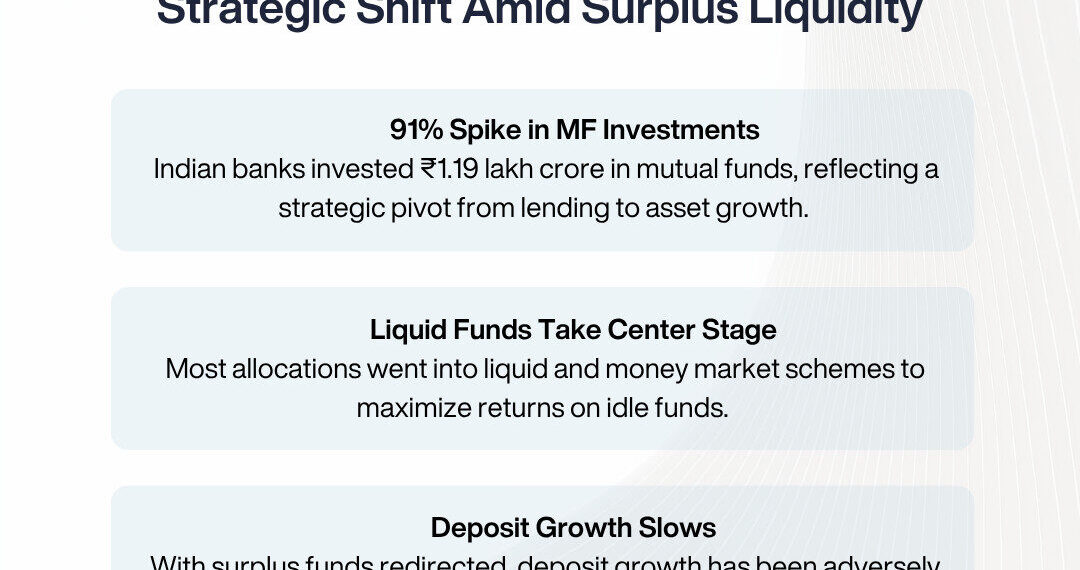

1️⃣91% Surge in Investments: Banks‘ investments in mutual funds soared by 91% to ₹1.19 lakh crore in FY25, as they sought better returns amid limited lending opportunities.

2️⃣Preference for Liquid and Money Market Schemes: Banks are primarily channeling funds into liquid and money market mutual fund schemes to optimize short-term returns.

3️⃣Impact on Deposit Growth: This trend has contributed to suppressed deposit growth, as banks allocate surplus funds to mutual funds instead of traditional deposit avenues.

🔍RTIwala: Empowering Financial Institutions

In this evolving financial landscape, RTIwala offers invaluable support to banks, SMEs, and startups by providing access to:

1️⃣Regulatory Insights: Obtain detailed information on compliance, licensing, and regulatory approvals essential for investment activities.

2️⃣Market Intelligence: Access comprehensive data on industry trends, competitor analysis, and market opportunities to inform strategic decisions.

3️⃣Due Diligence Support: Leverage RTIwala’s resources to conduct thorough due diligence, ensuring informed and secure investment decisions.

🌍The Banking and Financial Services Industry Leaders:

These are HDFC Bank, State Bank of India, ICICI Bank, Axis Bank, and Kotak Mahindra Bank — some of the popular companies innovating in the mutual fund and liquidity management industry.

🚀And, these are the remarkable startups of banking and investment industry:

Groww, Zerodha, INDmoney, and Kuvera — transforming retail investment and digital wealth management in India.

Get any government data, info, or record through @RTIwala!

Website: RTIwala.com now!

📞 Ready to Expand Your Legal Horizons?

Contact: +91-7999-50-6996 for help!

Connect with RTIwala today to access exclusive data and insights that can drive your financial growth in the dynamic banking sector.

#RTIwala #Legaltech #AskRTIwala #Finance #Investing #Strategy #Liquidity #Growth