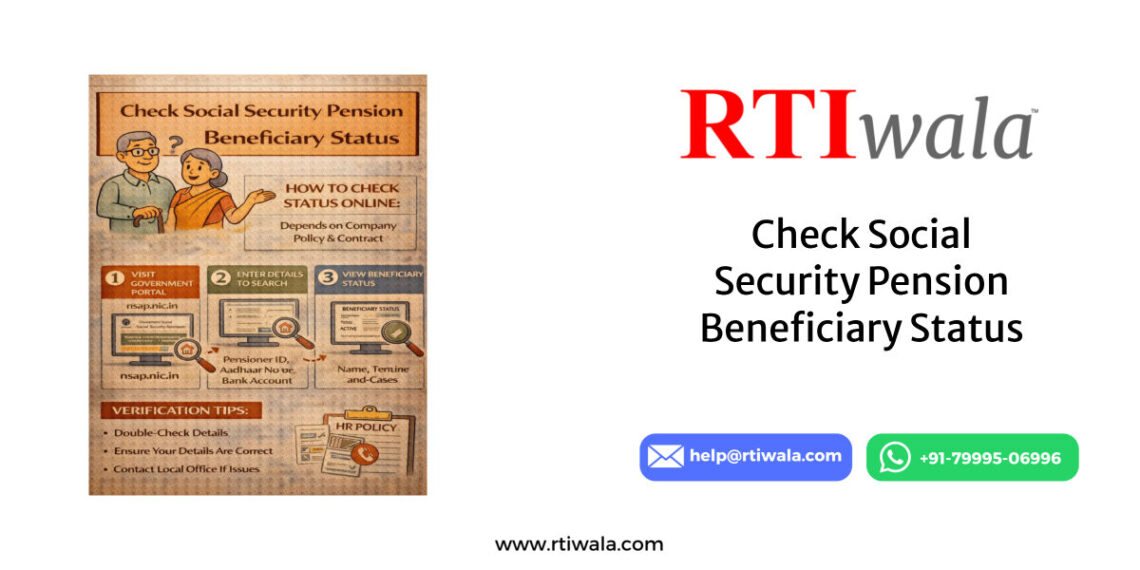

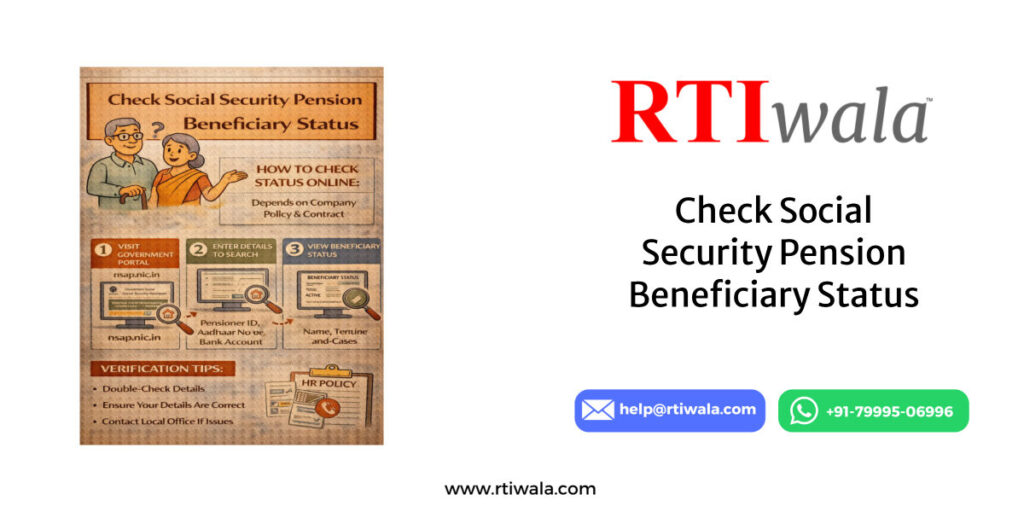

How to Check Social Security Pension Beneficiary Status Online

Many pension beneficiaries in India struggle with uncertainty—Has the pension been approved? Has the amount been released? Why is there no SMS or bank credit?

Checking the Social Security Pension Beneficiary Status online is the only reliable way to get clarity without visiting government offices repeatedly.

Most social security pensions in India—Old Age Pension, Widow Pension, Disability Pension—are processed digitally at the state level.

This means beneficiaries can track their pension status using official government portals from home, provided they know where and how to check correctly.

Why Checking Pension Status Online Is Important

Checking your pension status online helps you:

- Confirm whether your application is approved, pending, or rejected

- Track monthly payment release status

- Identify delays, failures, or missing details

- Avoid misinformation from local agents or middlemen

Many beneficiaries assume that approval means automatic payment.

In reality, approvals and payments are handled separately, and delays often occur after approval, which can only be identified online.

Who Can Check Social Security Pension Status Online

You can check pension status online if you are:

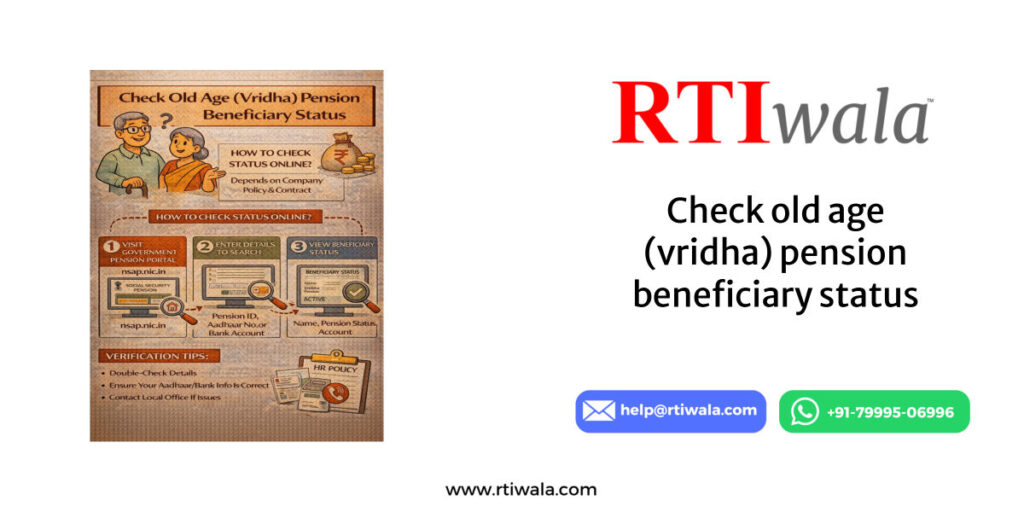

- An Old Age Pension (Vridha Pension) beneficiary

- A Widow (Vidhwa) Pension beneficiary

- A Divyang / Disability Pension beneficiary

- A family member checking status on behalf of a beneficiary

Most portals allow status checks using basic identification details, without login or passwords.

General Steps to Check Pension Beneficiary Status Online

Although each state portal differs slightly, the process usually follows these steps:

- Visit the official state social security pension portal

- Select Beneficiary Status or Payment Status

- Enter required details such as Aadhaar, Account Number, or Pension ID

- View approval and payment information on screen

The key challenge is not the process—but finding the correct official portal, which varies state by state.

Pension approved but money not credited? RTIwala traces the exact delay reason and fixes it legally—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Official Government Portals to Track Pension Payment Status

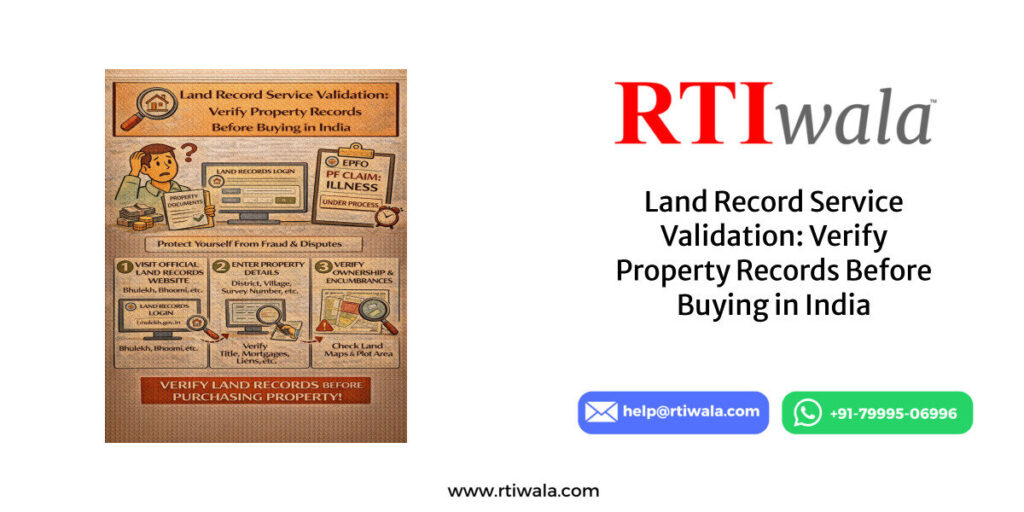

Social Security Pension schemes in India are implemented by State Governments, even though funding may come from the central government.

This means there is no single national portal for pension tracking—each state operates its own official system.

Below are the most commonly used official government portals for tracking pension beneficiary and payment status.

National-Level Reference (Scheme Information)

The National Social Assistance Programme provides overall scheme guidelines, but does not show individual payment status.

For actual beneficiary status, state portals must be used.

Bihar – e-Labharthi Portal

Bihar beneficiaries can track pension details on the e-Labharthi Portal.

This portal shows:

- Beneficiary approval status

- Monthly payment release details

- Bank account credit information

It supports Old Age, Widow, and Disability pensions under one system.

Uttar Pradesh – Social Welfare Pension Portal

Uttar Pradesh operates pension tracking through the state Social Welfare Department portal.

Beneficiaries can:

- Check beneficiary list

- Track installment-wise payment status

- Verify bank transfer details

Separate sections exist for old age, widow, and disability pensions.

Rajasthan – Social Justice Pension System

Rajasthan’s Social Justice Department provides online pension status tracking.

Users can search using:

- Jan Aadhaar

- Pension ID

- Bank account details

Payment history and current month status are usually visible.

Madhya Pradesh – Samagra Portal

Madhya Pradesh pension beneficiaries use the Samagra ID based system.

The portal allows:

- Family-based beneficiary search

- Pension eligibility verification

- Payment release tracking

Incorrect Samagra linkage is a common cause of payment delays here.

Telangana, Karnataka, Maharashtra & Other States

Most other states follow a similar structure:

- State Social Welfare or Rural Development website

- Separate pension scheme sections

- Search via Aadhaar, Account Number, or Pension ID

However, portal usability and data accuracy vary widely, leading to confusion even after checking status online.

Common Problems Faced on Official Portals

Even official portals often show:

- “Data not found” errors

- Old or outdated payment status

- Approved status but no payment history

- Missing bank transaction references

This is where beneficiaries feel stuck—status exists, but clarity does not.

Pension approved but money not credited? RTIwala traces the exact delay reason and fixes it legally—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

Details Required to Check Pension Status (Aadhaar, Account, ID)

Most beneficiaries face problems not because the pension is stopped, but because incorrect or incomplete details are used while checking status.

Government portals fetch data from multiple databases, so entering the right identifier is critical to get accurate results.

Different states accept different identifiers.

Knowing which detail to use on which portal saves time and avoids confusion like “No record found.”

Aadhaar Number

Aadhaar is the most commonly accepted identifier across states.

Pension records are usually seeded with Aadhaar during application or verification.

Key points to remember:

- Aadhaar must be linked with the pension record

- Name and date of birth should match Aadhaar data

- Bank account should be Aadhaar-seeded for DBT

Aadhaar verification is governed by Unique Identification Authority of India, and even a small mismatch can block status visibility or payment.

Bank Account Number

Many portals allow pension status checks using the bank account number used for pension credit.

This is useful when Aadhaar search fails or is not updated.

Before using account number:

- Ensure the account is active and not dormant

- Confirm the account is not recently changed

- Verify IFSC and branch details are correct

If the pension is approved but account details were updated later, status may not reflect correctly.

Pension ID / Beneficiary ID

Every approved pension application is assigned a Pension ID or Beneficiary Number.

This is the most accurate way to check status, but many beneficiaries do not preserve it.

You can usually find the Pension ID:

- On approval letters

- On SMS received during sanction

- On state pension beneficiary lists

Without this ID, portals may show incomplete or partial information.

State-Specific IDs (Samagra, Jan Aadhaar, Ration Card)

Some states use additional identifiers:

- Samagra ID (Madhya Pradesh)

- Jan Aadhaar (Rajasthan)

- Ration Card Number (older pension databases)

Using the wrong ID type on the wrong portal is a common reason for “No Data Found” errors.

Common Mistakes While Entering Details

Many beneficiaries unknowingly make these errors:

- Entering Aadhaar where Pension ID is required

- Using family Aadhaar instead of beneficiary Aadhaar

- Entering old bank account numbers

- Checking status on the wrong state portal

These mistakes lead to panic, even when the pension is active.

Pension approved but money not credited? RTIwala traces the exact delay reason and fixes it legally—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

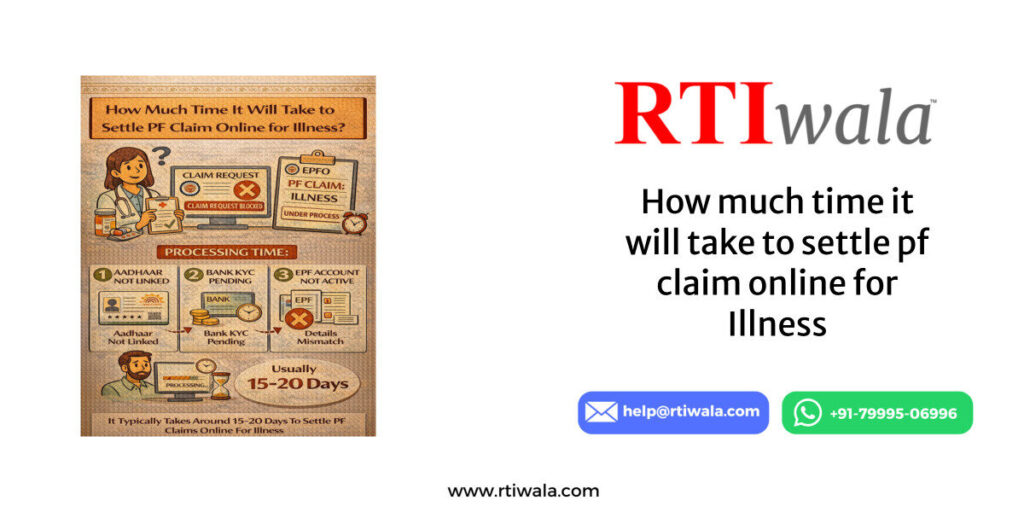

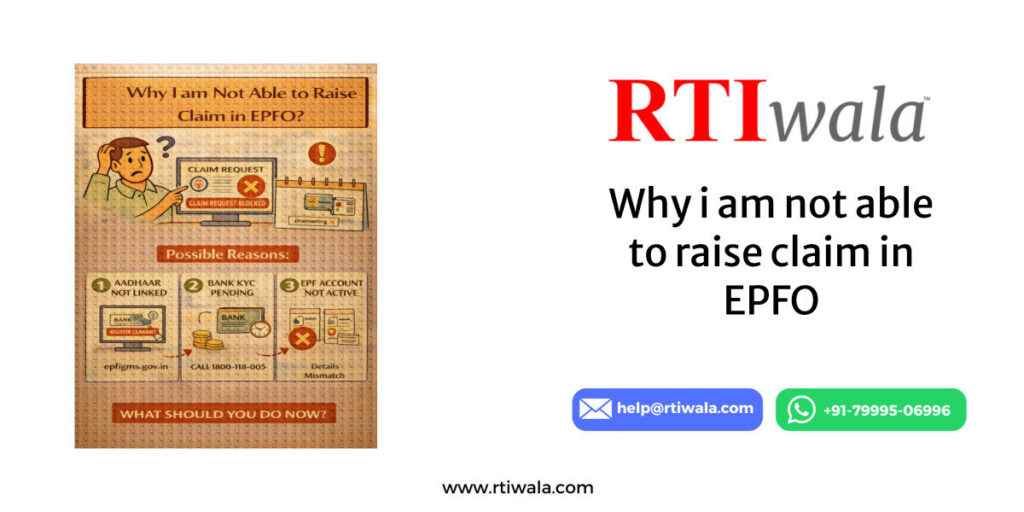

Reasons Why Social Security Pension Status Shows Pending or Failed

Seeing Pending, Failed, or Under Process status is one of the most frustrating experiences for pension beneficiaries.

This status does not always mean rejection—it usually indicates backend or administrative issues.

Understanding the exact reason helps decide the next action instead of waiting blindly.

Bank Account Related Issues

The most common reason for failed or pending pension status is bank account problems.

This includes:

- Dormant or inactive bank accounts

- Incorrect IFSC or branch mapping

- Account not linked with Aadhaar

- Account closed without updating pension records

Even approved pensions fail if the bank rejects the transaction.

Aadhaar Seeding or Verification Failure

If Aadhaar is not properly verified or seeded:

- DBT (Direct Benefit Transfer) fails

- Portal may show “Approved but Payment Pending”

- Status may not update for months

Minor spelling mismatches between Aadhaar and pension records can block payments silently.

Annual Verification or Life Certificate Issues

Many states require periodic life verification to continue pension payments.

If this verification is missed:

- Pension status changes to pending

- Payments are automatically paused

- No SMS or formal notice is sent

This is common among senior citizens and disabled beneficiaries.

Data Not Updated at District or Block Level

Pension data flows from:

- Village / Ward level

- Block / Tehsil level

- District approval systems

If updates are stuck at any level:

- Status shows pending despite eligibility

- Payment approval does not move forward

- Portal shows outdated information

This delay is administrative, not beneficiary-driven.

Change in Eligibility or Scheme Rules

Pension can be paused if:

- Income criteria changes

- Duplicate beneficiary detected

- Migration to another district/state

- Scheme guidelines updated without notice

In most cases, beneficiaries are not informed clearly about these changes.

Technical or Portal Synchronization Errors

Government portals often suffer from:

- Server delays

- Data sync failures between departments

- Old payment records not reflecting updates

This creates confusion where ground reality and online status do not match.

What to Do If Pension Amount Is Not Credited Despite Approval

Many beneficiaries see their pension status as “Approved”, yet the amount never reaches their bank account.

This situation is common and usually linked to backend or administrative issues rather than rejection.

Instead of waiting indefinitely, beneficiaries must take specific, corrective actions based on where the process is stuck.

Step 1: Verify Bank Credit Independently

First, confirm whether the pension amount was actually credited and reversed later.

You should:

- Check bank passbook or statement

- Ask the bank about failed DBT transactions

- Confirm whether any credit was returned to the government

Sometimes money is credited and auto-reversed without beneficiary knowledge.

Step 2: Recheck Bank and Aadhaar Linking Status

Even after approval, payment can fail if bank details are incorrect or outdated.

Verify the following:

- Bank account is active and operational

- Aadhaar is properly seeded with the bank

- IFSC code matches the pension records

A single mismatch is enough to block monthly payments.

Step 3: Check Last Payment Month and Remarks

Most portals show last paid installment and remarks column.

Look carefully for:

- “Payment initiated” but not credited

- “Transaction failed”

- “Pending at treasury” or “Under process”

These remarks indicate where the delay is occurring—bank, treasury, or department.

Step 4: Contact Local Pension Office (Block or Municipality)

If online status does not change for weeks, approach the local implementing office.

Carry:

- Aadhaar copy

- Bank passbook

- Pension ID or application number

Request them to check backend logs, not just portal status.

Step 5: Avoid Agents and Middlemen

Many beneficiaries are misled by agents promising “fast release” of pension.

Remember:

- Pension payments cannot be expedited unofficially

- No private agent has authority over government DBT systems

- Paying agents often worsens record mismatches

Only official correction or written verification works.

Pension approved but money not credited? RTIwala traces the exact delay reason and fixes it legally—contact now.

📞 Call: +91-7999-50-6996

💬 WhatsApp: https://help.rti.link/

🌐 www.rtiwala.com

How to Raise a Complaint or Verify Pension Status Through RTI

When repeated follow-ups fail and there is no clear explanation for pension delay, the most effective legal tool is the Right to Information (RTI).

RTI allows beneficiaries to demand written accountability from the department handling their pension.

Why RTI Is Effective in Pension Cases

RTI works because it:

- Forces officials to reply within a fixed legal timeframe

- Requires document-based answers, not verbal excuses

- Creates an official record of delay or negligence

Unlike complaints, RTI responses are legally binding.

What Information Can Be Asked Through RTI

A properly drafted RTI can seek:

- Exact reason for non-credit of approved pension

- Date of fund release from treasury

- Bank transaction reference numbers

- Officer responsible for payment delay

- Rules or orders under which payment is pending

This clarity is rarely provided through helpdesks or portals.

Which Authority to File RTI With

RTI should be filed to the department implementing the pension, such as:

- Social Welfare Department

- Rural Development Department

- Municipal or Panchayat pension office

RTI replies ultimately fall under oversight of the Central Information Commission or State Information Commissions.

Common Mistakes Beneficiaries Make in RTI

RTIs fail when:

- Questions are vague or emotional

- Wrong department is addressed

- Too many unrelated questions are asked

- Legal timelines are not tracked

A poorly drafted RTI can be ignored or transferred endlessly.

How RTI Verification Solves Pension Delays

Once RTI is filed:

- Departments are compelled to trace files

- Pending approvals move faster

- Bank and treasury errors surface clearly

- Responsibility is fixed on specific officers

In many cases, pension payments resume even before RTI reply, due to internal pressure.

When RTI Is the Only Practical Option

RTI becomes essential when:

- Pension is approved but unpaid for months

- Portal status does not change

- Offices give verbal assurances only

- Complaints remain unanswered

RTI converts uncertainty into documented truth.

Frequently Asked Questions (FAQs)

1. How can I check my social security pension beneficiary status online?

You can check your pension status by visiting your state government’s official pension portal and entering Aadhaar, bank account number, or Pension ID. The status shows approval, payment history, or pending remarks.

2. Which government website shows social security pension payment status?

There is no single national website for pension payments. Each state has its own official portal such as Bihar’s e-Labharthi, UP Social Welfare portal, or Rajasthan Social Justice portal for beneficiary tracking.

3. Why does my pension status show approved but the amount is not credited?

This usually happens due to bank account issues, Aadhaar seeding failure, treasury delay, or transaction rejection. Approval and payment are processed separately, so approval alone does not guarantee credit.

4. What details are required to check pension status online?

Most portals require Aadhaar number, bank account number, Pension ID, or state-specific ID like Samagra or Jan Aadhaar. Entering incorrect or outdated details often results in “No record found.”

5. What should I do if my pension payment shows failed or pending for months?

First verify bank and Aadhaar linkage, then check portal remarks. If the issue continues despite approval, contact the local pension office. If no clear answer is given, filing an RTI is the most effective solution.

6. Can I raise an RTI to know why my pension is delayed?

Yes. You can file an RTI to ask for the exact reason for non-payment, fund release date, bank transaction details, and responsible officer. RTI forces the department to give a written, time-bound reply.

7. How long does it take to get a response through RTI for pension verification?

By law, RTI authorities must respond within 30 days. In many pension cases, payments resume even before the RTI reply due to internal accountability pressure.